Game asset ownership in 2025 is nearly unrecognizable compared to just a few years ago. The rise of playable NFTs has upended the traditional paradigm, granting players verifiable and transferable control over their in-game assets. This shift is not just technological – it’s fundamentally altering player incentives, game design, and the economics of digital worlds.

The New Era: True Ownership and Interoperability

Until recently, in-game assets were little more than licenses, players could purchase skins, weapons, or characters but had no real ownership. The publisher dictated terms and access. In 2025, playable NFTs have changed this dynamic entirely. Now, when you acquire an NFT-based item in a game like Illuvium or The Sandbox, you genuinely own it on-chain. This means you can trade it on any compatible marketplace, transfer it between wallets, or even use it across different games that support interoperability protocols.

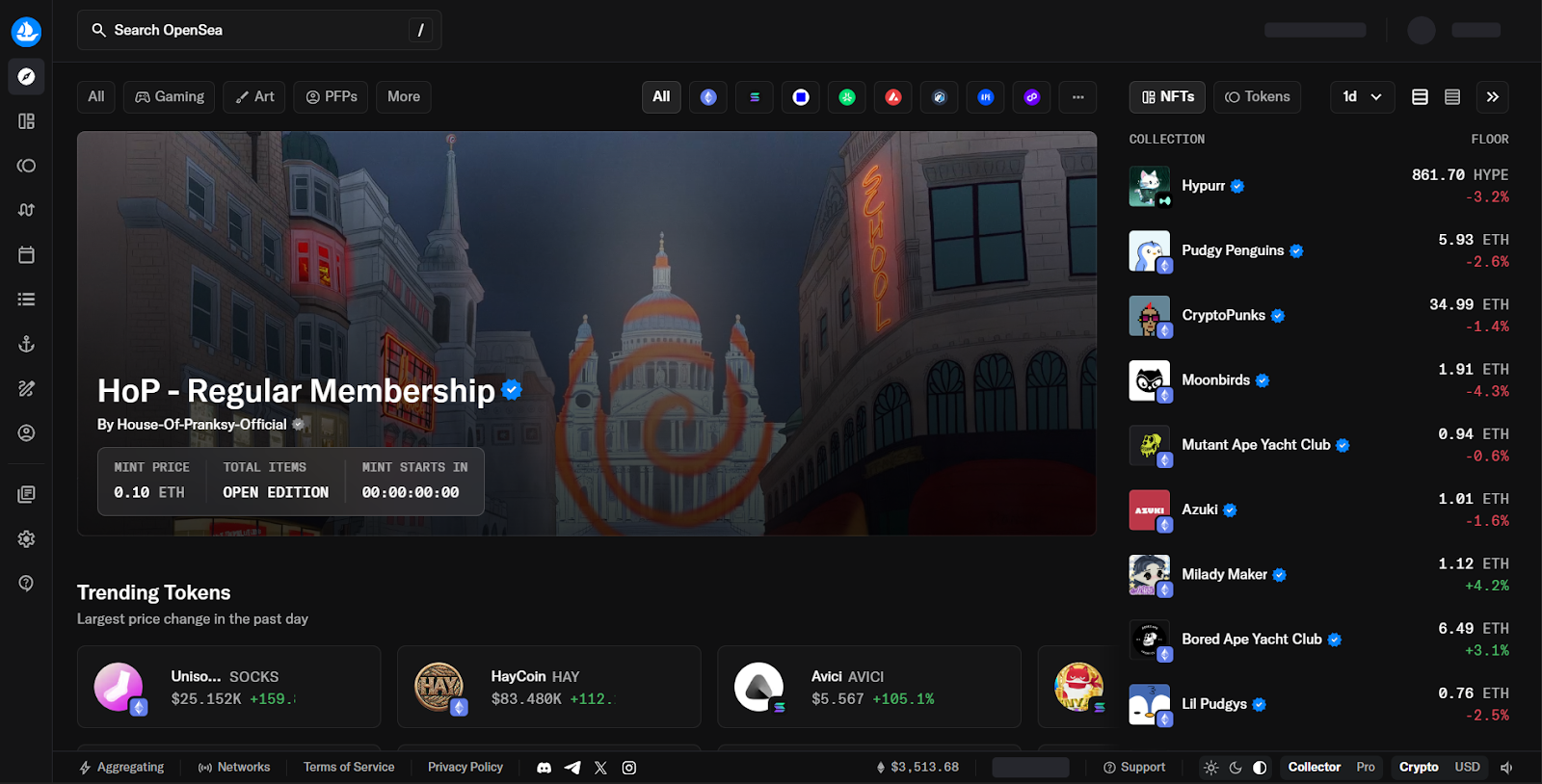

This interoperability is one of the most exciting developments in the NFT gaming economy. Imagine wielding a rare sword from one RPG as a cosmetic or functional item in another title, a reality enabled by standardized NFT metadata and cross-platform partnerships. According to recent analyses by Alchemy and CoinNews, platforms like OpenSea (with 2.4 million monthly active users) and Magic Eden (1.5 million) are leading this movement by supporting seamless cross-game asset transfers.

Playable NFTs: Driving Decentralized Player Economies

The impact of playable NFTs goes far beyond simple trading or collecting. They are the backbone of a new breed of decentralized economies where players are stakeholders rather than mere consumers. In contrast to legacy systems where publishers could devalue items at will, blockchain-backed ownership ensures that scarcity and provenance are transparent and immutable.

This has catalyzed the rise of Play-to-Own (P2O) models, an evolution from play-to-earn systems that often suffered from inflationary tokenomics and unsustainable rewards structures. In P2O ecosystems such as Axie Infinity’s revamped platform or The Sandbox’s creator economy, players earn assets with intrinsic value that can be held for long-term appreciation or traded for profit on open markets.

The result? A thriving secondary market where value discovery happens organically through player interaction rather than top-down control. As reported by Future Market Insights, the dynamic NFT market alone is projected to grow from $693.1 million in 2025 to over $12 billion by 2035, a testament to the staying power of these innovations.

Key Platforms and Games Shaping Asset Ownership

A handful of pioneering games are setting benchmarks for what’s possible with playable NFTs:

- Illuvium: An open-world RPG where every creature (Illuvial) is an NFT that can be captured, trained, battled, or sold freely across marketplaces.

- The Sandbox: A robust metaverse builder empowering users to create experiences and monetize land parcels or assets as interoperable NFTs using SAND tokens.

- Axie Infinity: Continues its evolution with new mechanics allowing Axies (NFT creatures) to cross into other games or applications, further boosting liquidity and utility for holders.

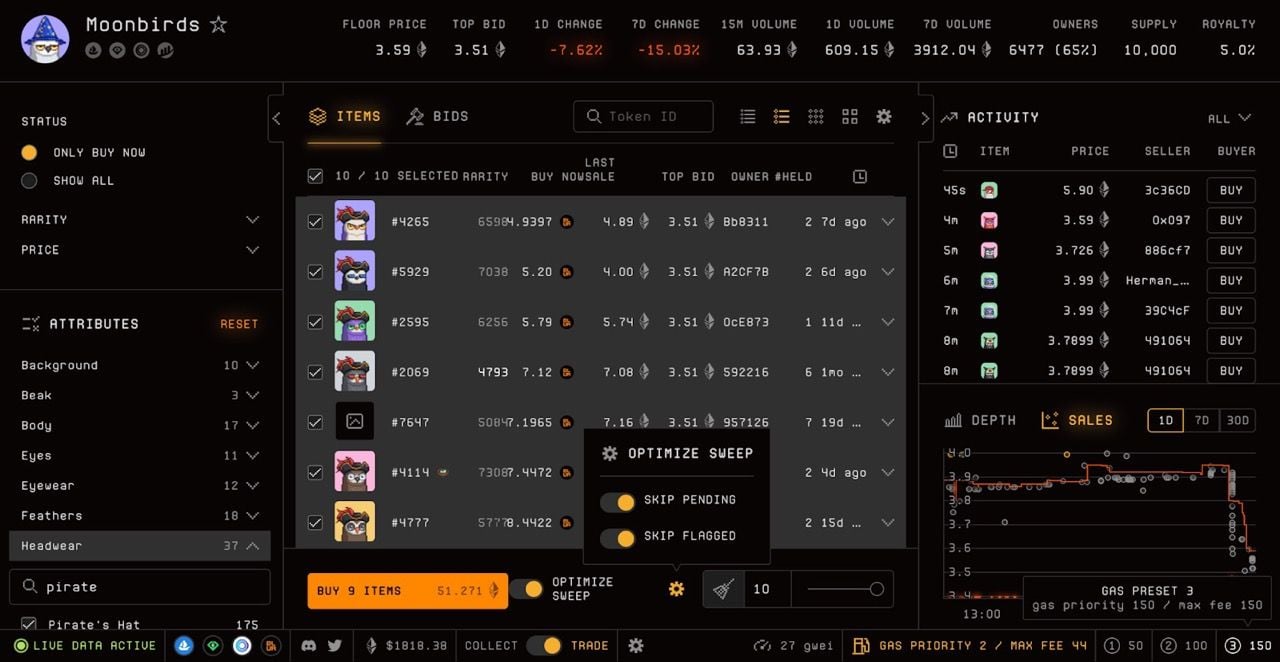

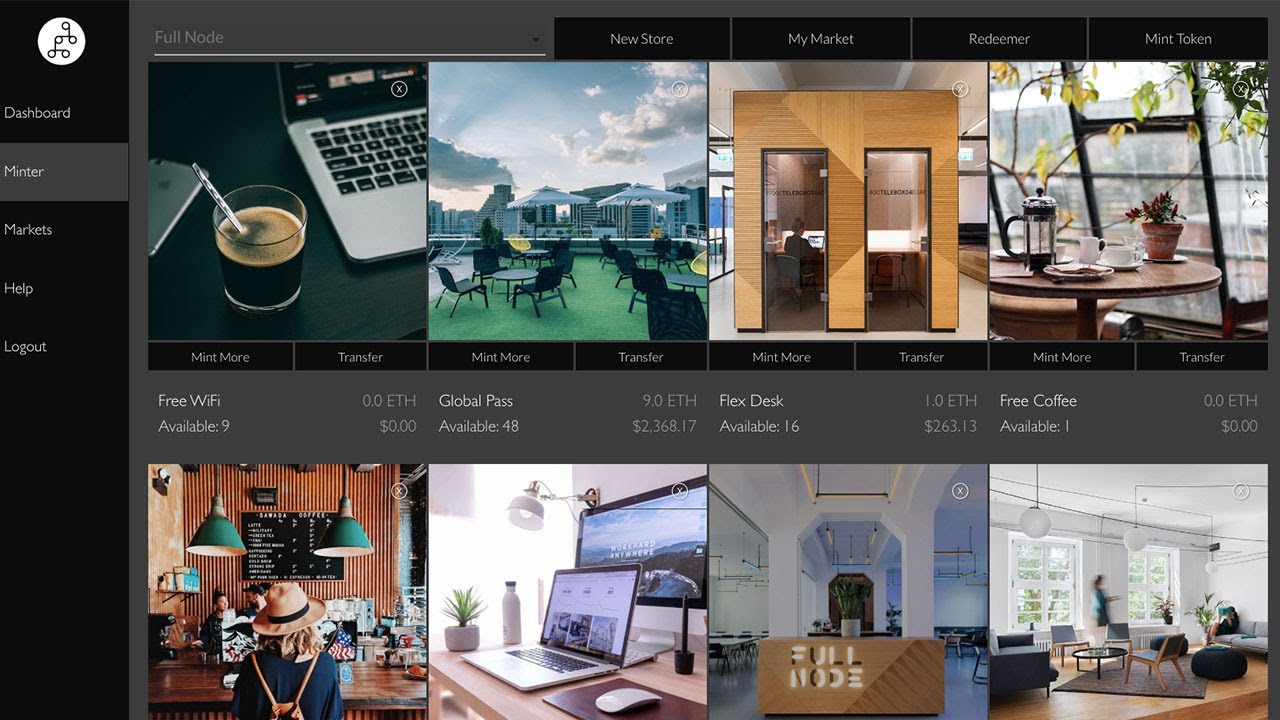

This ecosystem is supported by a growing roster of specialized marketplaces catering specifically to gaming NFTs, 18 major platforms according to Alchemy’s Dapp Store listing for 2025 alone. These platforms offer advanced features such as real-time price tracking, NFT staking rewards for long-term holders, and robust on-chain metadata analytics for informed value discovery.

If you’re interested in deeper analysis on how these trends are transforming both asset value and player identity within games, see our related coverage at How Playable NFTs Are Revolutionizing In-Game Asset Value And Player Identity In 2025.

While the technology powering playable NFTs matures, we’re also seeing a shift in player expectations and developer strategies. Gamers now demand assets that retain value across time and platforms, while studios recognize the benefits of building open economies. The days of locked, non-transferable skins are fading; instead, interactive NFTs with on-chain metadata and dynamic attributes are becoming the norm. This supports not just cosmetic variety but also functional evolution, items that level up, change appearance, or unlock new abilities based on gameplay milestones.

The emergence of NFT staking rewards is another trend gaining traction in 2025. By locking up rare game assets on platforms like Magic Eden or Blur, players can earn passive income or exclusive perks without needing to sell their prized collectibles. This mechanism aligns incentives between long-term holders and ecosystem growth, fostering healthier economies compared to the short-term speculation seen in earlier cycles.

Top 5 Gaming NFT Marketplaces for Playable NFTs in 2025

-

OpenSea remains the largest NFT marketplace in 2025, boasting over 2.4 million monthly active users. It offers extensive support for playable NFTs, enabling seamless trading and interoperability of in-game assets across multiple blockchain networks.

-

Magic Eden has solidified its position as a leading platform for gaming NFTs, with a focus on cross-chain compatibility and a robust ecosystem for both creators and players. Its user base has grown to 1.5 million monthly active users in 2025.

-

Blur is popular among professional NFT traders and has expanded its offerings to include dynamic, playable NFTs. Its advanced analytics and trading tools make it a favorite for serious gamers and investors.

-

Rarible stands out for its community-driven approach and support for customizable, playable NFTs. In 2025, it continues to innovate with features that empower creators and gamers to mint, trade, and utilize assets across different games.

-

Mintbase has emerged as a key platform for interoperable, playable NFTs, especially within the NEAR Protocol ecosystem. Its emphasis on low transaction fees and easy asset creation appeals to both indie developers and established studios.

Marketplaces Powering the Playable NFT Boom

The backbone of this revolution lies in robust NFT marketplaces tailored to gaming needs. OpenSea continues to dominate with its vast selection and liquidity, but specialized platforms like Magic Eden (with a strong focus on gaming assets), Blur (for pro traders), and Rarible are carving out significant market share by offering advanced analytics, low-fee trading, and interoperability features.

Importantly, these marketplaces are not just trading hubs, they serve as discovery engines for new games and assets. Features such as real-time price widgets, detailed rarity charts, and social integration via live feeds or community polls help users make informed decisions. As highlighted by CoinNews and VeVe Blog analyses, collectors can now seamlessly browse categories from digital art to domain names to in-game items, all within unified interfaces designed for both casual gamers and professional asset managers.

Risks and Considerations for Investors

Despite the excitement around NFT game assets in 2025, prudent investors should remain vigilant. The rapid pace of innovation means standards are still evolving; not all NFTs will be interoperable or retain utility across ecosystems. Additionally, while dynamic NFTs offer enhanced value discovery through on-chain metadata updates, they can introduce complexity around provenance tracking and authenticity verification.

Market volatility remains a concern as well. Although the global NFT market is projected to reach $231.98 billion by 2030 (according to Blockchain App Factory), short-term price swings can be dramatic, especially for newly launched games or speculative assets. Diversification across established titles (like Illuvium or The Sandbox) alongside emerging projects may help mitigate risk.

If you want a deeper dive into how play-to-own models will transform NFT economies moving forward, check out our comprehensive guide at How Play-to-Own Gaming Will Transform NFT Economies In 2025.

Looking Ahead: The Future of Game Asset Ownership

The momentum behind playable NFTs is unmistakable, and it’s only accelerating as interoperability protocols become more sophisticated and mainstream adoption grows. With players empowered as true asset owners and developers incentivized to foster open economies rather than walled gardens, we’re witnessing a fundamental redefinition of digital property rights within gaming.

This transformation is not without challenges, regulatory uncertainty around digital ownership persists in some jurisdictions, but the direction is clear: NFT-based economies will underpin the next decade of interactive entertainment. For those willing to engage thoughtfully with this evolving landscape, whether as gamers, creators, or investors, the opportunities have never been more compelling.