The NFT gaming landscape is in the midst of a seismic shift, and at the heart of this evolution is DAO governance. If you’re a gamer, developer, or NFT enthusiast, you’ve probably noticed the buzz around decentralized autonomous organizations (DAOs) and their growing influence in shaping how NFT games are built, managed, and even monetized. This isn’t just hype – it’s a fundamental change in who holds power in virtual worlds.

From Centralized Control to Community Power

Traditionally, game development studios called all the shots: patch notes, asset drops, economic tweaks – every major decision flowed from a central authority. But DAOs are flipping that script. By leveraging blockchain tech and smart contracts, DAOs enable community-driven decision making where players and stakeholders can directly influence everything from gameplay mechanics to treasury management.

Take UMA Technology’s breakdown: through governance tokens or NFTs, players gain voting rights on proposals that affect the game world. Imagine having a real say in how your favorite game evolves! This level of inclusion not only builds loyalty but also aligns development with what players actually want.

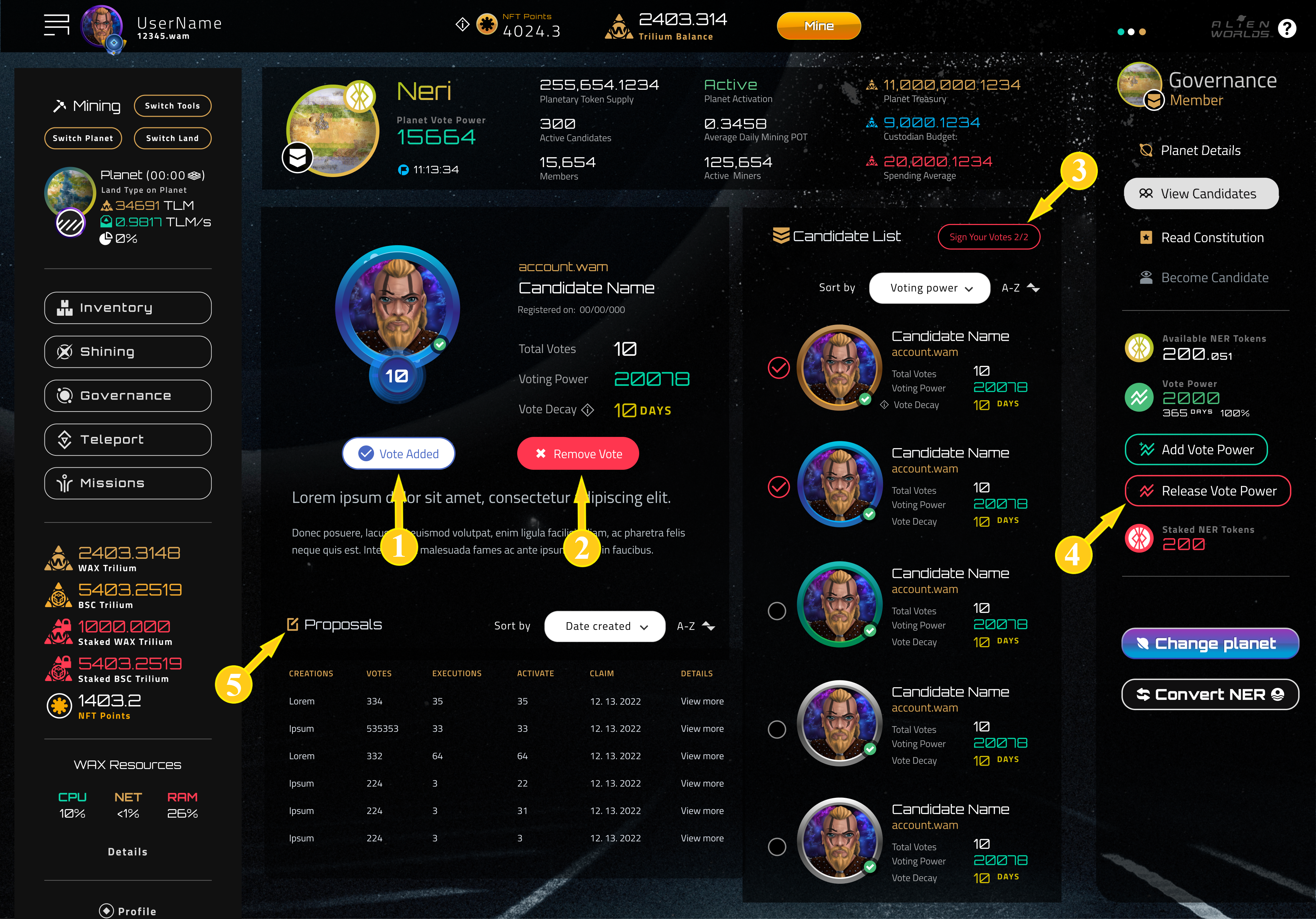

Innovative Tokenization Models: The Alien Worlds Example

If you want to see DAO governance NFT gaming done right, look no further than Alien Worlds. Their ecosystem features six DAOs known as Planetary Syndicates. Each manages its own treasury of Trilium (TLM) tokens and oversees specific in-game activities. This multi-layered approach gives players granular control over resource allocation and event planning – it’s like running your own digital nation-state within the metaverse!

This model isn’t just for show; it’s driving real engagement and economic activity. As more games adopt similar frameworks, expect to see even more creative tokenization strategies emerge – blending fungible tokens for utility with unique NFTs for status and influence.

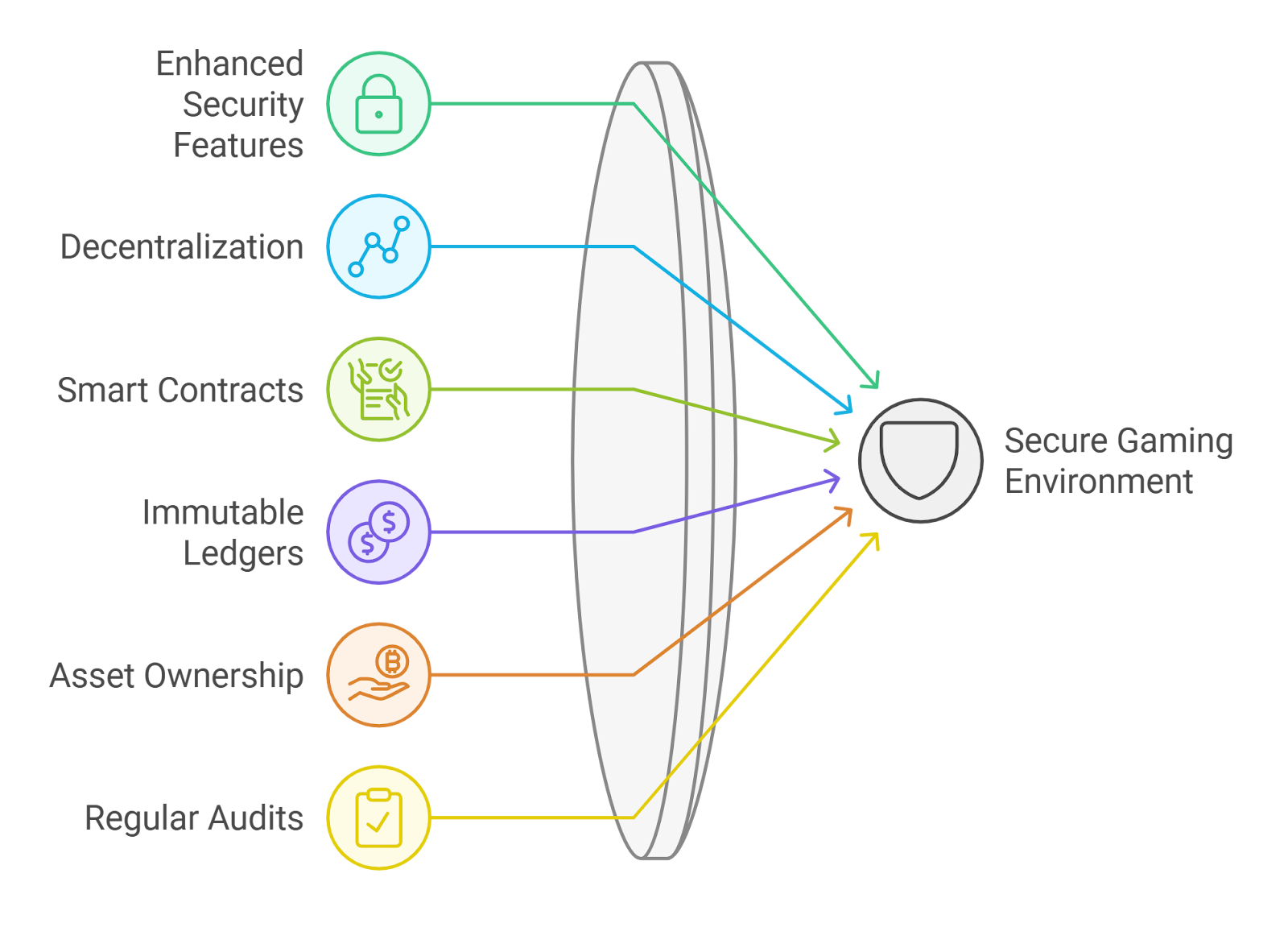

Transparency and Trust: Why Blockchain Matters

One of the biggest selling points for DAOs in NFT gaming is radical transparency. Every vote, transaction, or change gets recorded on-chain via smart contracts. That means no more wondering if devs are pulling strings behind closed doors – every stakeholder can audit decisions themselves.

This open ledger system doesn’t just build trust; it also reduces friction between communities and developers by making processes clear and verifiable. According to UMA Technology’s report, this transparency is already fostering tighter-knit communities who feel genuinely invested in their game’s future.

Ethereum, MANA, SAND, and AXS Price Predictions (2026-2031)

Forecasts based on DAO adoption in NFT gaming, current 2025 market data, and evolving blockchain trends

| Year | ETH Min Price | ETH Avg Price | ETH Max Price | MANA Min Price | MANA Avg Price | MANA Max Price | SAND Min Price | SAND Avg Price | SAND Max Price | AXS Min Price | AXS Avg Price | AXS Max Price |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2026 | $3,900 | $5,200 | $6,700 | $0.28 | $0.39 | $0.54 | $0.26 | $0.36 | $0.50 | $2.10 | $2.85 | $4.00 |

| 2027 | $4,200 | $5,800 | $7,800 | $0.32 | $0.46 | $0.66 | $0.29 | $0.43 | $0.62 | $2.40 | $3.20 | $4.60 |

| 2028 | $4,700 | $6,700 | $9,200 | $0.36 | $0.55 | $0.81 | $0.33 | $0.52 | $0.78 | $2.70 | $3.65 | $5.30 |

| 2029 | $5,300 | $7,800 | $11,000 | $0.40 | $0.65 | $1.00 | $0.37 | $0.62 | $1.00 | $3.10 | $4.25 | $6.20 |

| 2030 | $6,200 | $9,100 | $13,300 | $0.46 | $0.77 | $1.25 | $0.43 | $0.75 | $1.25 | $3.60 | $5.00 | $7.30 |

| 2031 | $7,200 | $10,600 | $15,800 | $0.53 | $0.90 | $1.53 | $0.50 | $0.89 | $1.55 | $4.20 | $5.90 | $8.60 |

Price Prediction Summary

From 2026 to 2031, Ethereum and leading NFT gaming tokens (MANA, SAND, AXS) are projected to experience steady growth, fueled by the increasing adoption of DAO governance in gaming ecosystems. Ethereum is expected to remain the foundational layer for NFT and DAO platforms, with its price potentially more than doubling by 2031 in bullish scenarios. MANA, SAND, and AXS, while subject to higher volatility, are likely to benefit from greater user engagement and token utility as play-to-earn models and decentralized governance mature. Minimum and maximum ranges account for both market corrections and potential bull runs, reflecting the cyclical nature of the crypto market.

Key Factors Affecting Ethereum Price

- DAO adoption in gaming: Greater DAO integration increases token utility and demand.

- Ethereum upgrades: Scalability and network improvements (e.g., sharding, Layer 2) could drive ETH price.

- NFT market cycles: Renewed NFT and metaverse interest may drive up MANA, SAND, and AXS.

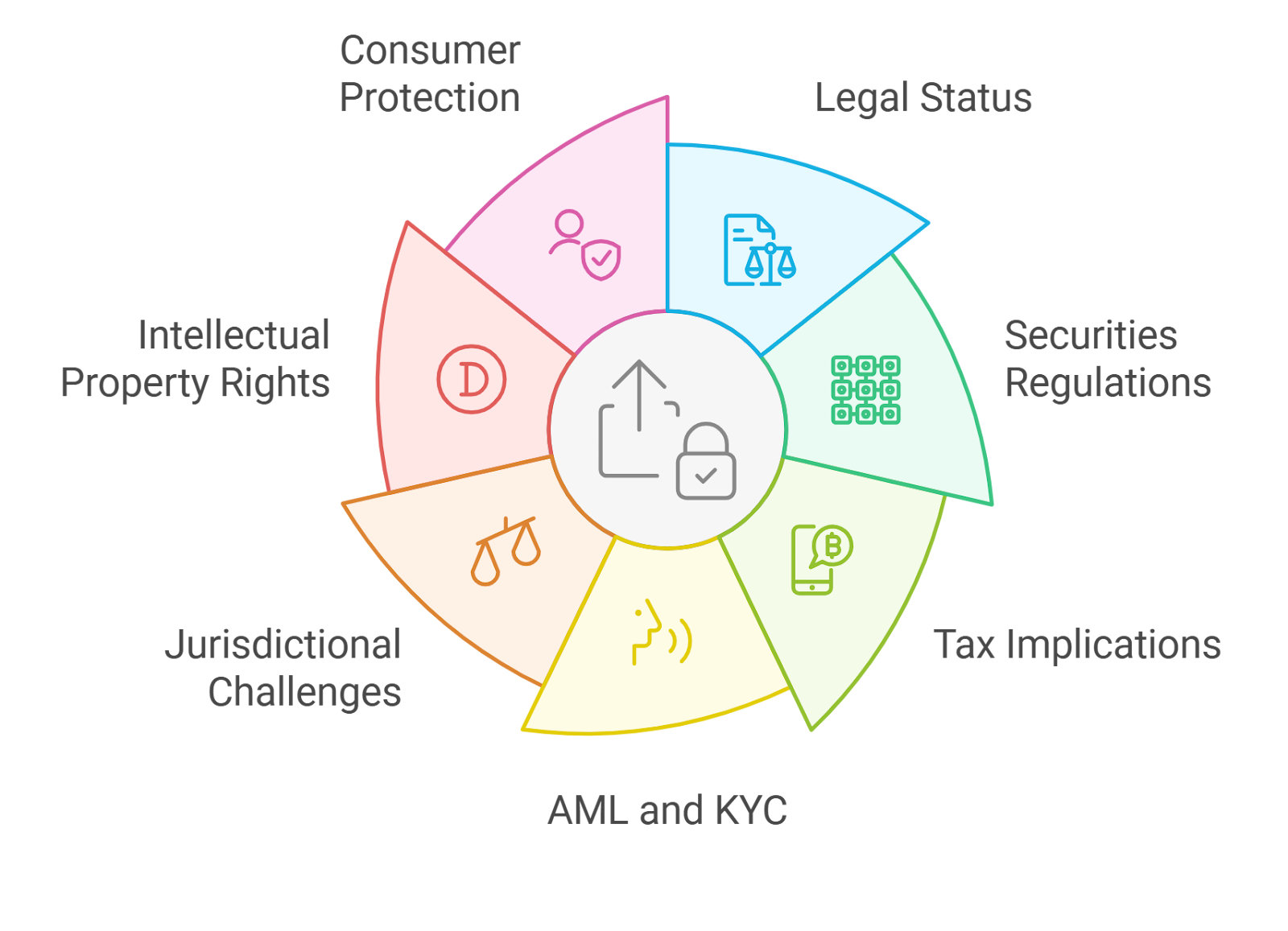

- Regulatory clarity: Clearer frameworks for gaming tokens and DAOs can boost investor confidence.

- Broader Web3 adoption: Growth in decentralized gaming and social platforms expands user bases.

- Competition: New blockchain gaming projects or L1/L2 solutions could impact market share.

- Macro conditions: Global economic trends and risk appetite will affect crypto investment flows.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Current Market Context: Prices Shape Governance Dynamics

The state of crypto markets directly impacts how DAOs operate within NFT games. As of September 19th, 2025:

- Ethereum (ETH): $4,469.97 (-2.91%)

- Decentraland (MANA): $0.325173 (-6.18%)

- The Sandbox (SAND): $0.301502 (-3.35%)

- Axie Infinity (AXS): $2.47 (-3.52%)

This volatility means that treasury management within DAOs isn’t just about voting on upgrades; it’s about navigating real financial risk with skin in the game.

Tackling Challenges: Participation and Efficiency

No revolution comes without its hurdles! While DAO governance brings unprecedented inclusion to NFT gaming DAOs, challenges like voter apathy and slow decision-making can threaten momentum if left unaddressed (Katana Inu Blog highlights these issues well). Some projects are experimenting with incentives for active participation or streamlined proposal systems to keep things moving efficiently.

Gamers who want their voices heard need to show up and vote, otherwise, the risk is that a vocal minority steers the direction of the entire ecosystem. Some DAOs are addressing this by introducing tiered voting power, delegation mechanisms, or even gamified participation rewards to nudge more players into action. The result? A governance structure that’s both robust and agile, capable of adapting to fast-moving markets and shifting community priorities.

Top Tips for Thriving in NFT Gaming DAOs

-

Understand Governance Tokens and Voting Rights: Most NFT gaming DAOs, like Alien Worlds or Decentraland, use governance tokens (e.g., TLM, MANA) to grant voting power. Learn how these tokens work and how to participate in proposals that shape game development and asset management.

-

Leverage Transparency for Informed Decisions: All DAO transactions and decisions are logged on the blockchain for complete transparency. Use block explorers (like Etherscan) to review past votes, treasury allocations, and smart contract activity before casting your vote.

-

Monitor Market Trends and Token Prices: The value of governance tokens can fluctuate. For example, as of September 19, 2025, Ethereum (ETH) is $4,469.97, Decentraland (MANA) is $0.325173, and The Sandbox (SAND) is $0.301502. Stay updated on prices to make strategic decisions about holding or using your tokens.

-

Advocate for Efficient Governance: DAOs can face challenges like voter apathy and slow decision-making. Propose or support initiatives that streamline voting processes and encourage wider participation—such as quorum thresholds or incentive programs—to help your DAO stay agile and effective.

Another emerging solution is off-chain signaling combined with on-chain execution. This hybrid approach lets communities discuss and debate proposals in accessible forums before any blockchain transaction occurs, saving gas fees and reducing friction for everyday players. As tooling improves, expect these processes to get even smoother, lowering barriers for newcomers while maintaining ironclad security.

What’s Next? The Future of Decentralized Governance in NFT Games

The momentum behind DAO governance NFT gaming isn’t slowing down. In fact, as more studios recognize the value of distributed decision-making, we’re likely to see new forms of player-driven economies emerge. Imagine games where every major feature launch, asset mint, or economic tweak passes through community consensus, creating a living world shaped by its inhabitants rather than dictated from above.

And let’s not forget the real-world impact: as crypto prices fluctuate (ETH at $4,469.97, MANA at $0.325173, SAND at $0.301502, AXS at $2.47), so too does the purchasing power and influence within these DAOs. Savvy gamers and investors are watching these numbers closely, not just for trading opportunities but as signals for when to push proposals or initiate treasury actions.

For developers looking to integrate decentralized governance into their titles, the playbook is getting clearer: start with transparent smart contracts, empower your most engaged users with meaningful voting rights (whether via NFTs or tokens), and build feedback loops that reward active participation. The result? Games that are more resilient, adaptive, and genuinely fun because they reflect what players actually want.

Get Involved: Your Vote Matters

If you’re passionate about your favorite NFT game’s future, or if you see untapped potential in its economy, the best way to make an impact is by joining its DAO governance process today. Whether you’re proposing new features, voting on treasury allocations, or simply participating in community discussions, your input can shape the next generation of virtual worlds.

The rise of decentralized governance isn’t just another trend, it’s a fundamental shift toward player empowerment and transparent digital economies. As DAO-enabled NFT games continue to evolve alongside volatile crypto markets, one thing is clear: those who engage early will help write the rules for everyone else.