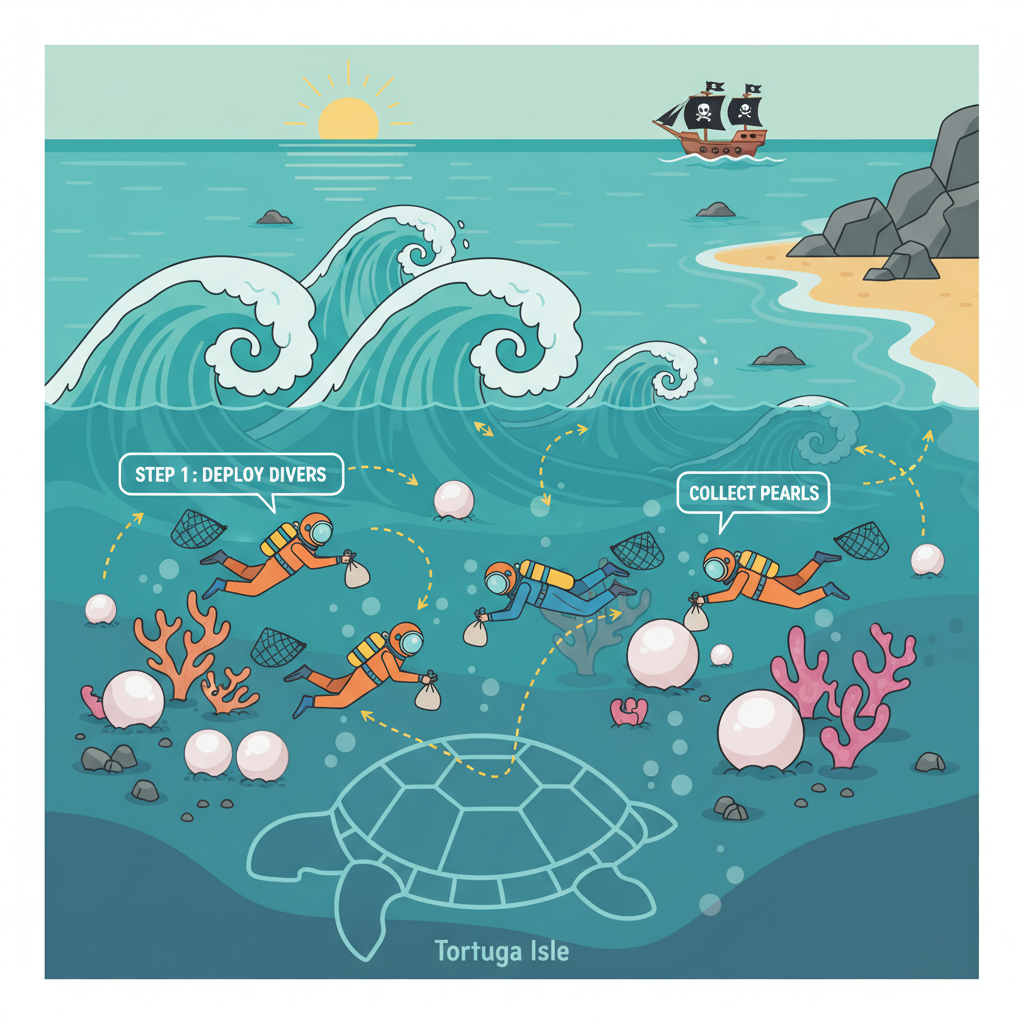

In the evolving Web3 gaming economy, Pearl Diver NFT Huts stand out as a prime example of how in-game assets can drive real value through play-to-earn mechanics. Players dive into a strategic world off Tortuga Isle, where crafting, trading, and burning resources transform simple dives into lucrative ventures. These huts aren’t just decorative; they amplify token earnings by boosting expedition yields and unlocking exclusive market edges.

Pearl Diver blends idle strategy with blockchain precision, letting you analyze real-time Caribbean weather patterns influenced by a Binance-linked trading bot. This dynamic setup rewards foresight: position your hut optimally, contribute to group dives, and watch Pearl tokens flow. Daily token burns mint unique NFTs, some harboring untapped utilities that savvy players stack for compounded gains.

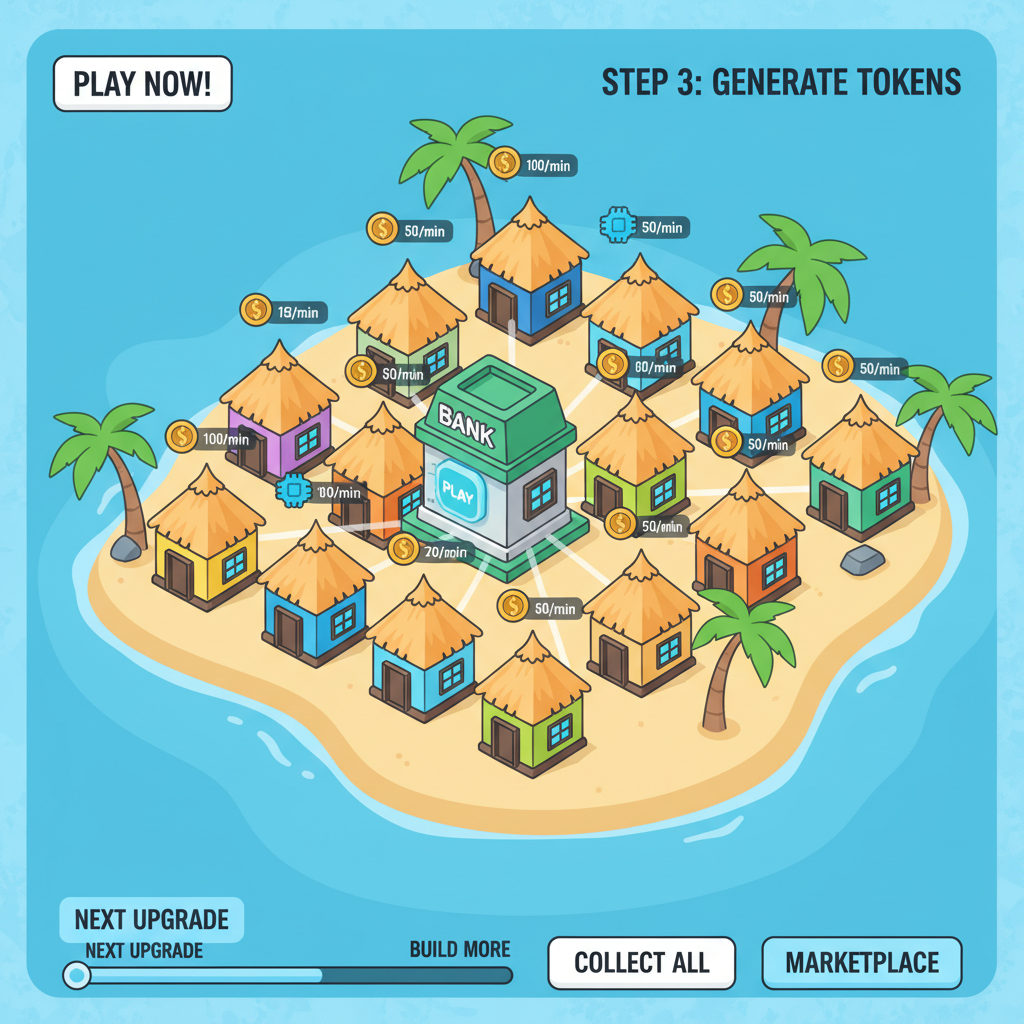

Strategic Power of NFT Huts in Pearl Diver

Pearl Diver NFT Huts elevate basic play-to-earn into a sophisticated asset management game. Start with a basic hut, then upgrade through resource chains: refine pearls, burn excess tokens, and craft advanced structures. A Medium Hut NFT, recently spotlighted in community giveaways at $33 value, slots directly into the game as a productivity booster. It enhances dive efficiency, multiplies token outputs, and opens doors to rare tool NFTs.

Think of huts as your island base camps. They passively generate Pearl tokens while you’re away, embodying the idle strategy core. But strategy shines in placement: weather bots dictate dive risks, so a well-positioned hut near sheltered coves minimizes losses and maximizes hauls. This player-driven layer turns NFTs from static collectibles into dynamic engines of in-game NFT assets.

Earning Pearl Tokens Through Expedition Synergies

Core to Pearl Diver’s appeal are the play-to-earn loops tied to NFT Huts. Launch expeditions by staking tokens and hut capacity; successful dives yield pearls convertible to Pearl tokens on BSC. Burn mechanics add deflationary pressure: a slice of supply vanishes daily, minting NFTs that holders can trade or deploy. Forward-looking players eye these burns as entry points to rarer tiers, where utility scales exponentially.

Market dynamics keep it engaging. Trade pearls on in-game exchanges, hedge against weather volatility, or pool with others for mega-dives. Huts scale your stake: a basic one handles solo runs, while advanced versions command group contributions, splitting amplified rewards. This fosters player-driven NFT marketplaces, where hut NFTs fetch premiums based on proven yield histories recorded on-chain.

Web3 Foundations for Long-Term Token Sustainability

Pearl Diver’s economy sidesteps common P2E pitfalls by prioritizing balance. Pearl tokens fuel everything from upgrades to trades, with burns ensuring scarcity amid growth. Huts integrate seamlessly, their on-chain metadata tracking performance metrics that inform marketplace valuations. In a sector rife with rug pulls, this transparency builds trust and positions Pearl Diver among top Web3 games crafting sustainable models.

Looking ahead, as play-to-earn NFTs BSC mature, Pearl Diver’s hut system previews scalable ownership. Players aren’t just earners; they’re stakeholders in an economy where strategic idling compounds wealth. Weather-linked bots introduce macro-like signals, training users in adaptive trading akin to real commodities markets. Early adopters stacking huts now stand to dominate as liquidity pools deepen and NFT utilities expand.

Forward-thinking investors recognize Pearl Diver’s hut NFTs as undervalued multipliers in the Web3 gaming economy. With on-chain provenance ensuring verifiable yields, these assets transcend hype, mirroring commodities futures where positioning anticipates volatility. As BSC’s low-fee rails accelerate transactions, hut holders gain frictionless edges in scaling operations.

Maximizing Yields: Deploying Huts for Optimal Token Flows

Success hinges on integration. Basic huts kickstart passive income, but stacking Medium or advanced variants unlocks synergies. Recent community spotlights, like giveaways of $33 Medium Huts, underscore accessibility; claim one, deploy it bayside, and watch expedition contributions compound. Refine pearls into tech chains, burn for rarity, and evolve your outpost into a token forge. This loop cements Pearl Diver NFT as a cornerstone for play-to-earn sustainability.

Player anecdotes reveal patterns: huts near bot-predicted calm zones yield 20-30% more pearls per dive. Group pooling amplifies this, with advanced huts commanding higher shares in mega-expeditions. It’s not grinding; it’s calibrated idling, where market analysis dictates moves. In my view, this mirrors FRM principles-hedge weather downside, leverage upside via NFT leverage.

Player-Driven Marketplaces and Emerging Utilities

Pearl Diver’s in-game bazaars pulse with hut trades, premiums tied to metadata like dive success rates. Top performers list at multiples, fueling a vibrant secondary market. As utilities unfold-burned NFTs tease governance votes or exclusive dives-this marketplace evolves into a true player-driven NFT marketplace. Watch for cross-game integrations; Tortuga Isle could anchor metaverse hubs.

Community momentum builds traction. X giveaways and DappRadar listings signal rising visibility, drawing BSC whales. Sustainable burns counter inflation, positioning Pearl tokens for listings beyond silos. For developers eyeing NFT blueprints, Pearl Diver exemplifies modular economies: plug-and-play huts adaptable to new chains.

Strategic minds stack now. Idle oversight via dashboards lets you pivot on bot signals, turning weather whims into predictable profits. Huts aren’t endpoints; they’re launchpads for empire-building in BSC’s P2E frontier.

Positioning for the Next Wave in Play-to-Earn

As Web3 matures, Pearl Diver charts a path where in-game NFT assets drive retention over extraction. Unlike flash-in-pan titles, its weather-bot realism instills discipline, prepping players for broader crypto volatility. Envision 2026: deepened liquidity, NFT lending protocols tied to huts, Pearl tokens bridging DeFi yields. Early positions compound asymmetrically; delay risks ceding ground to hut barons.

Blend macro vigilance with micro execution. Monitor burns for mint drops, align deployments with forecasts, trade pearls preemptively. This alchemy elevates casual dives to portfolio-grade plays. Pearl Diver doesn’t just reward play; it forges adaptable strategists primed for NFT economies’ ascent.