In the evolving landscape of digital gaming, Web3 MMORPGs stand at the vanguard, empowering players with unprecedented control over player owned in-game assets. As we navigate 2025, blockchain integration has propelled the sector forward, with the web3 gaming market expanding from $32.33 billion in 2024 to a projected $39.65 billion this year. This surge underscores a pivotal shift: true ownership via NFTs, transforming virtual worlds into vibrant, player-driven economies ripe for strategic investment.

NFTs in these MMORPGs are no longer mere collectibles; they represent verifiable scarcity and liquidity. Players can mint, trade, or deploy assets across ecosystems, bypassing traditional game publisher gatekeepers. This model, highlighted in games like The Sandbox, where virtual land trades on OpenSea, signals a macro trend toward web3 mmorpg ownership. Forward-thinking gamers recognize this as a hedge against centralized platforms, positioning NFTs as core infrastructure for nft gaming economies 2025.

Redefining Ownership Through Blockchain Integration

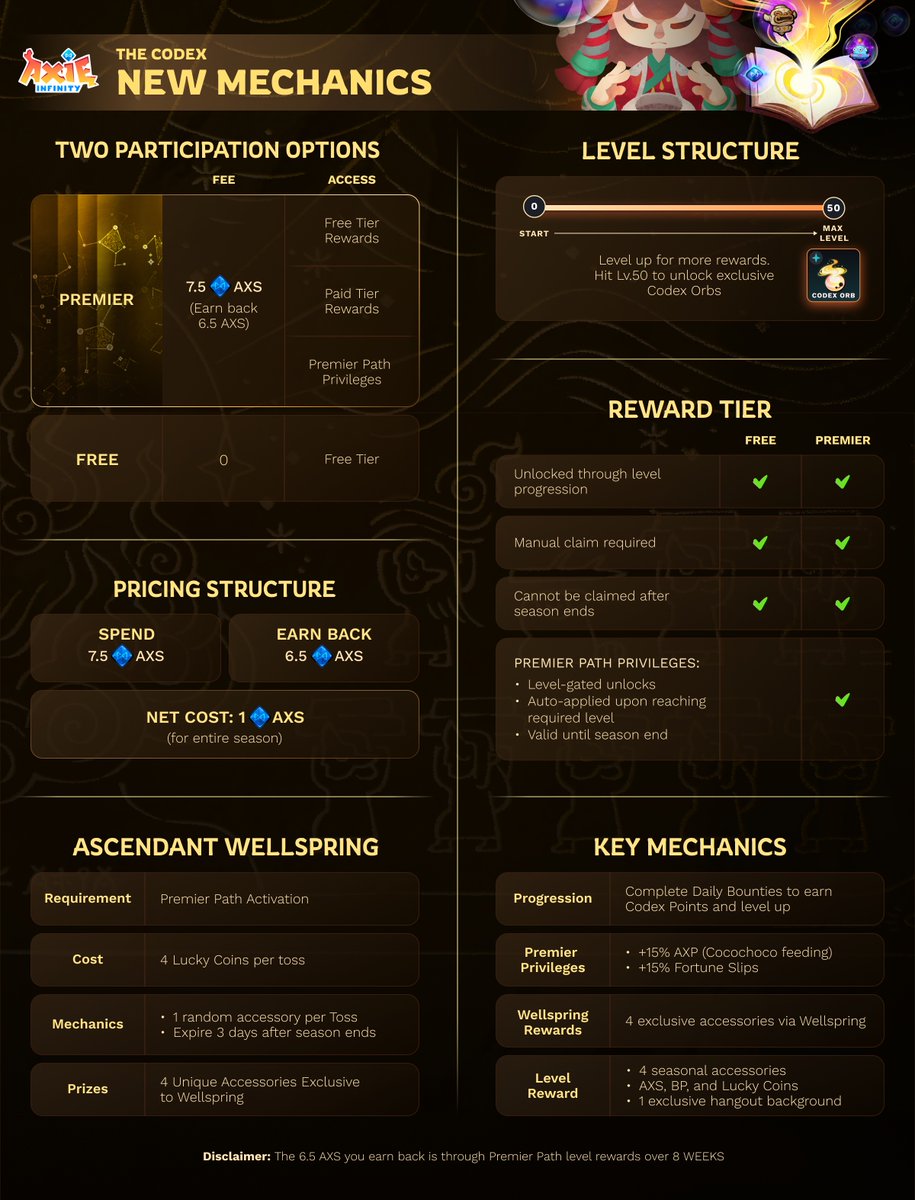

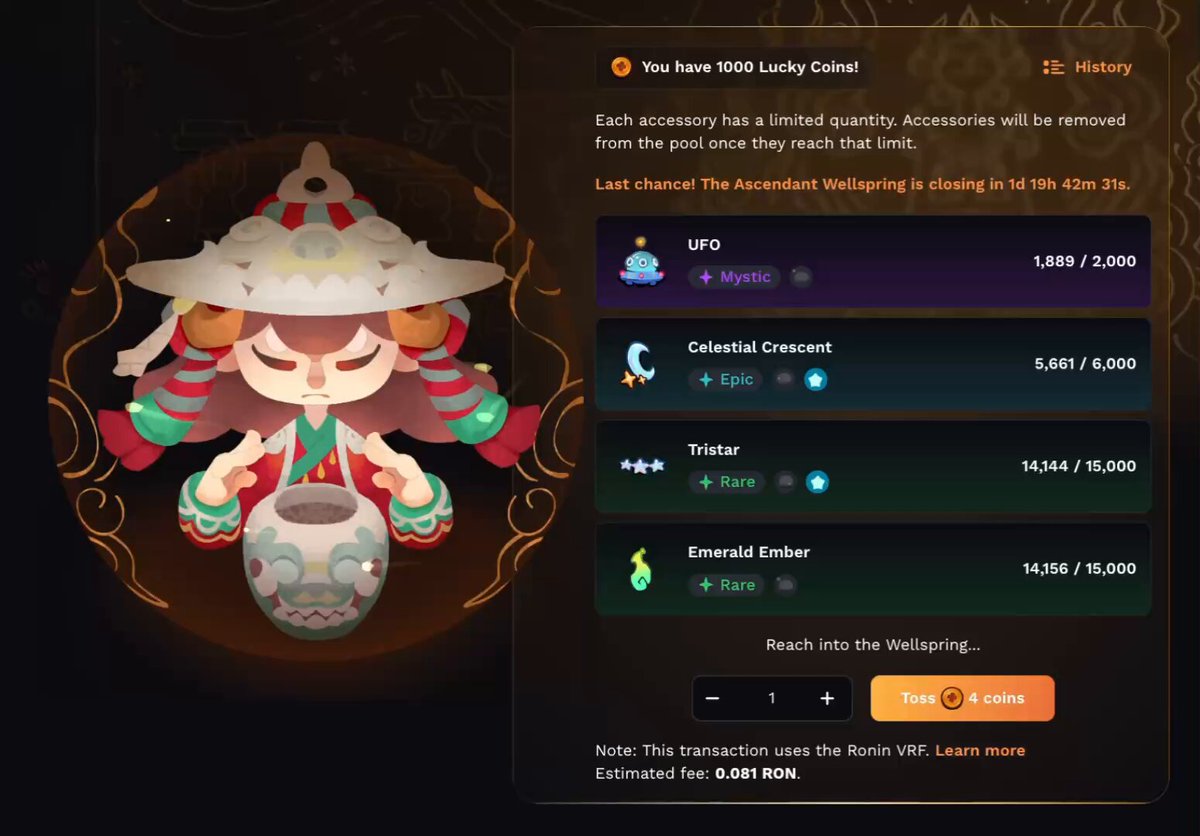

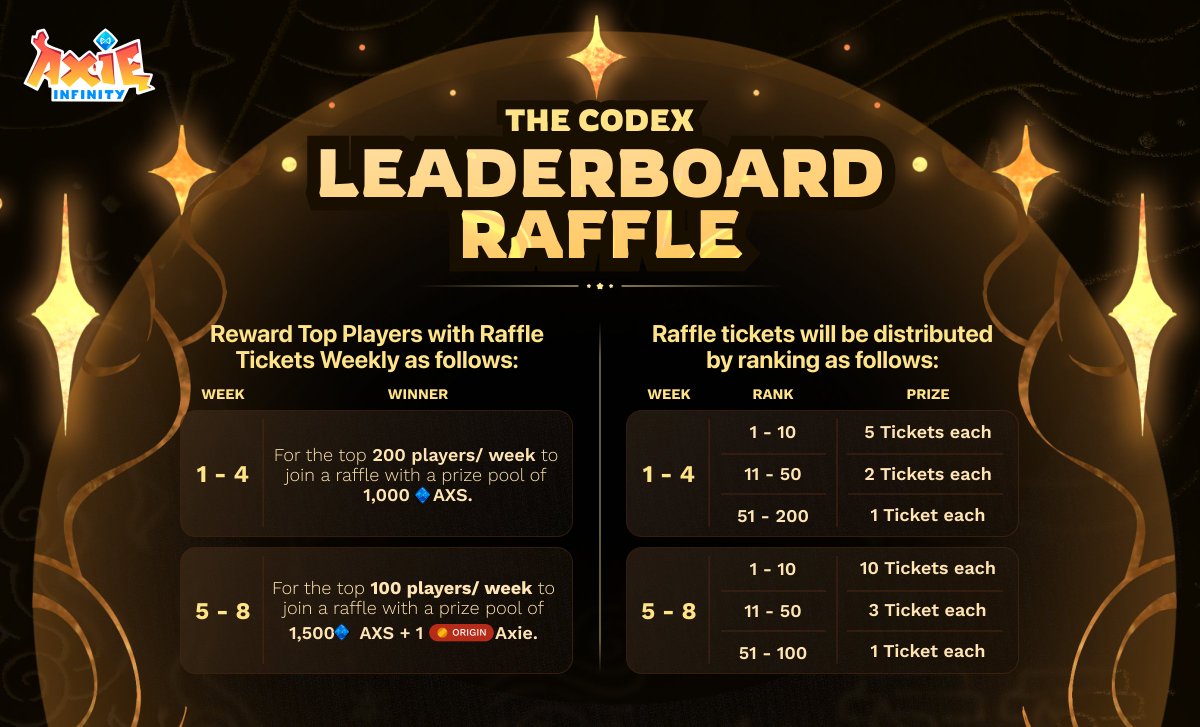

At the heart of Web3 MMORPGs lies blockchain’s promise of sovereignty. In-game items as NFTs grant players full dominion, enabling cross-platform utility and resale value. Consider Axie Infinity’s pivot with Axie Origins in June 2025: AI-enhanced NPCs and tokenized rewards drove a 30% spike in daily active users within days. Such innovations blend entertainment with economic agency, where staking tokens or yield farming becomes second nature.

Layer 2 solutions on Ethereum have slashed fees and boosted speeds, making these transactions seamless. Yet, strategic players must weigh interoperability risks; assets thriving in one title may falter elsewhere without robust standards. This demands a discerning approach, favoring protocols with DAO-backed governance like Decentraland’s land policies.

Play-to-Earn Mechanics Fueling Sustainable Economies

P2E models have matured beyond hype, anchoring metaverse player economies. Players earn tokens for quests, battles, or social contributions, convertible to fiat or reinvested for compounding yields. The gaming NFT market, valued at $4.8 billion last year, eyes $44.1 billion growth at 24.8% CAGR, propelled by these dynamics.

Top Emerging Web3 MMORPGs

-

Bit Hotel: Retro social MMO with NFT hotel rooms, customizable spaces, events, and mini-game earnings.

-

Lumiterra: Open-world survival crafting with NFT assets for resource gathering, crafting, and alliances.

-

Chainers: Browser-based PvP MMO offering free starter NFTs, farming, crafting, and real-time battles.

-

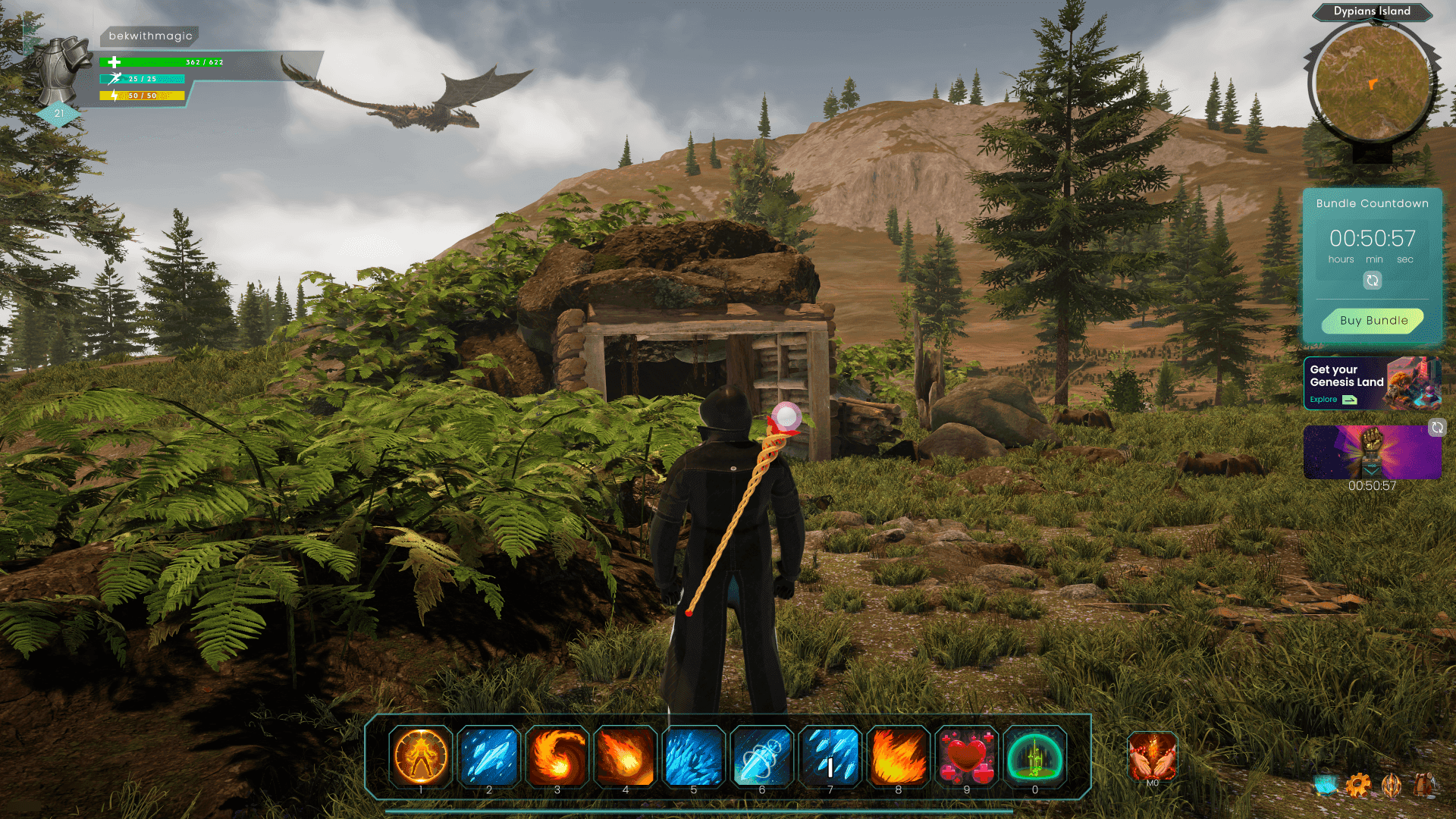

World of Dypians: 3D metaverse for NFT land ownership, building, exploration; 2.5M+ community.

In Lumiterra’s open-world survival, every resource gathered manifests as an NFT, tradable in alliance markets. Chainers democratizes access via browser play and starter packs, lowering entry barriers for mass adoption. These titles exemplify how P2E evolves into balanced ecosystems, where passive income via staking coexists with skill-based progression.

Emerging Titles Shaping 2025’s Landscape

Bit Hotel merges nostalgia with profitability, letting owners host NFT-fueled events in customizable rooms. World of Dypians, with its 2.5 million-strong community, turns 3D exploration into land speculation opportunities. Analysts forecast the broader Web3 gaming sector hitting $182.98 billion by 2034 at 19% CAGR, but success hinges on titles mastering player retention over speculation. Playable NFTs emerge as differentiators, blending utility with fun to sustain long-term engagement.

Strategic positioning in these economies requires blending on-chain analytics with gameplay mastery. As DAOs empower voting on updates, players evolve from consumers to stakeholders, crafting resilient virtual realms.

Scalability hurdles persist, testing the mettle of even the most promising chains. High gas fees during peak hours can erode thin margins for casual players, underscoring the need for Layer 2 dominance. Ethereum’s upgrades have mitigated this, but competitors like BNB Chain beckon with native staking integrations that yield passive returns within gameplay loops. Savvy participants monitor on-chain metrics; surging transaction volumes signal robust health, while stagnant TVL warns of fading momentum.

Navigating Risks in Player-Driven Markets

Speculative froth has cooled since early booms, yet web3 mmorpg nfts still tempt overleveraged bets. Rug pulls and exploitable smart contracts loom as pitfalls, demanding rigorous due diligence on audit trails and developer vesting schedules. On-chain forensics reveal whale concentrations that could dump assets post-hype, eroding liquidity. Forward strategists prioritize games with locked emissions and deflationary mechanics, ensuring token scarcity bolsters long-term value accrual.

User onboarding remains a friction point. Wallet setups and seed phrases deter traditional gamers, but browser-based entries like Chainers chip away at this barrier, onboarding via free NFTs. True scale demands seamless fiat ramps and social logins, evolving metaverse player economies toward mainstream viability.

Web3 Gaming Market Projections

| Year | Market Size ($B) | CAGR (%) |

|---|---|---|

| 2024 | $32.33 | – |

| 2025 | $39.65 | 22.6% |

| 2034 | $182.98 | 19% |

Strategic Plays for 2025 Dominance

Positioning for alpha requires a hybrid lens: technical overlays on volume spikes paired with fundamental audits of DAO proposals. In Bit Hotel, event-hosting yields correlate with community sentiment scores, tradable as NFT multipliers. Lumiterra’s alliance crafting favors coordinated guilds, mirroring real-world commodity pools where bulk resources command premiums.

Investors eye cross-chain bridges for asset portability, amplifying utility in interoperable hubs. World of Dypians exemplifies this, its 3D parcels fueling a secondary market where prime real estate appreciates 15-20% quarterly on average, per recent on-chain sales data. NFT-based economies thrive here, with player marketplaces supplanting developer shops.

Macro tailwinds align: regulatory clarity on digital assets post-2025 frameworks could unlock institutional inflows, swelling TVL. Pair this with AI NPCs optimizing economies, as in Axie Origins, and P2E matures into hybrid models blending fun with yields. Games ignoring this risk commoditization, outpaced by adaptive protocols.

Decentralized governance cements loyalty; DAOs in Decentraland demonstrate how player votes refine mechanics, boosting retention 25% per governance cycle. Track participation rates: high quorum signals aligned incentives, low turnout flags apathy.

Macro Outlook: Betting on Resilient Chains

By late 2025, winners will emerge from scalability proofs and retention battles. Web3 gaming’s trajectory to $182.98 billion by 2034 hinges on embedding ownership sans speculation overload. Strategic allocators diversify across top MMORPGs, staking for yields while flipping high-beta NFTs during hype cycles.

Layer with off-chain signals: Discord activity, GitHub commits, and alpha tester feedback predict breakouts. In this nexus of gaming and finance, player owned in-game assets redefine value capture. Those mastering on-chain edges will not just play; they will architect tomorrow’s digital frontiers.