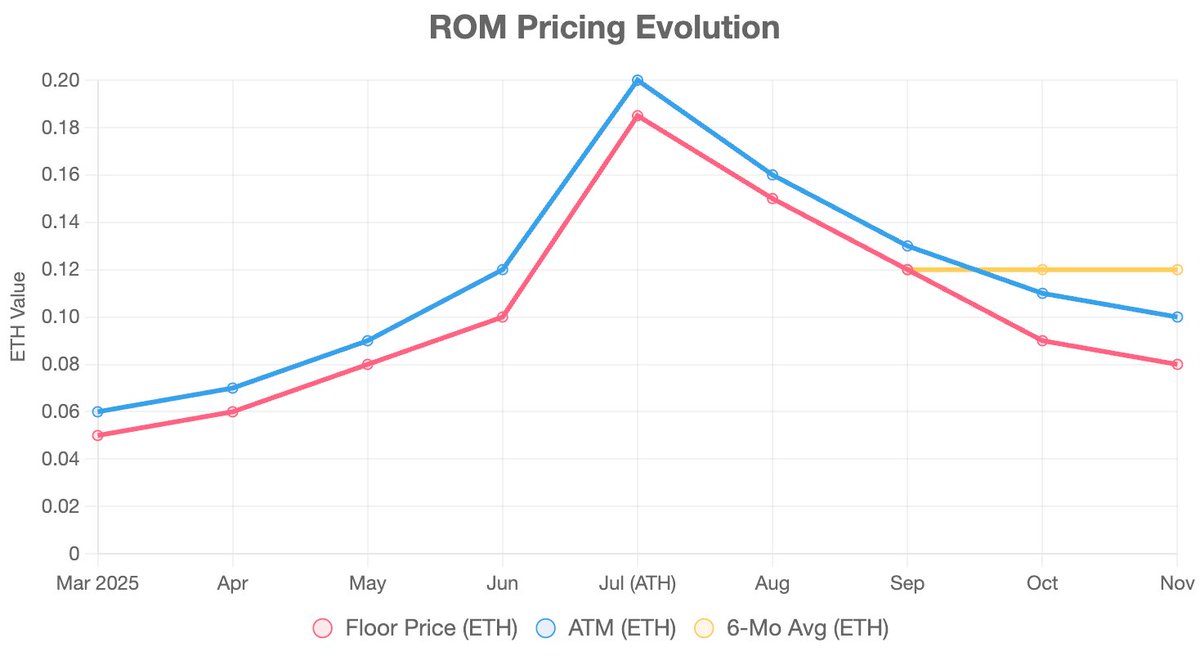

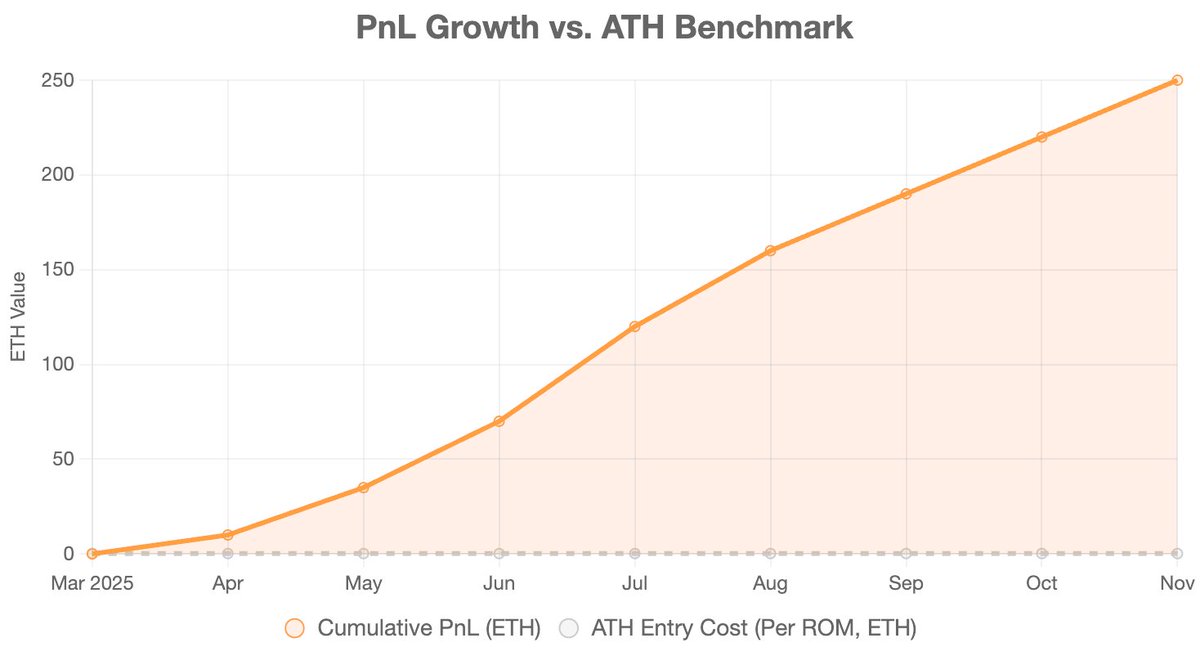

In a Web3 gaming landscape where skeptics declare NFTs are dead, Gigaverse ROMs NFTs shatter the narrative. Minted at 0.05 ETH just months ago, these ERC-721 assets now command a floor price of 0.0899 ETH, approximately $270.28, marking a 79.8% appreciation that leaves all-time high buyers in the dust. This isn’t hype-fueled speculation; it’s utility-driven dominance in a player-owned RPG economy.

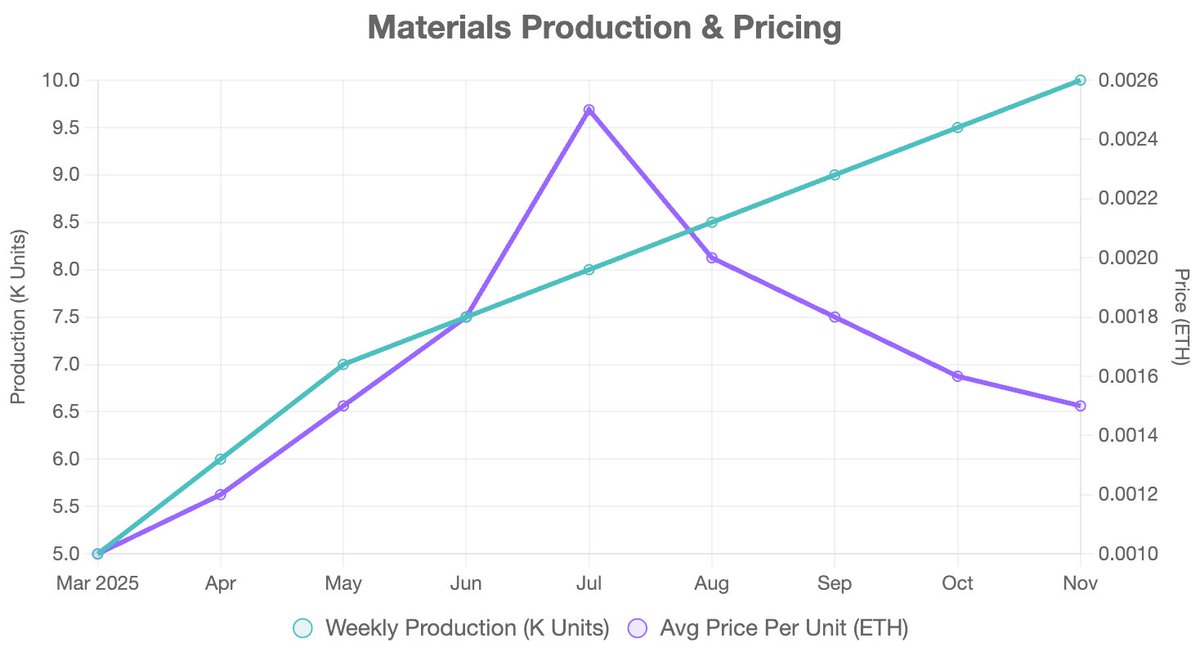

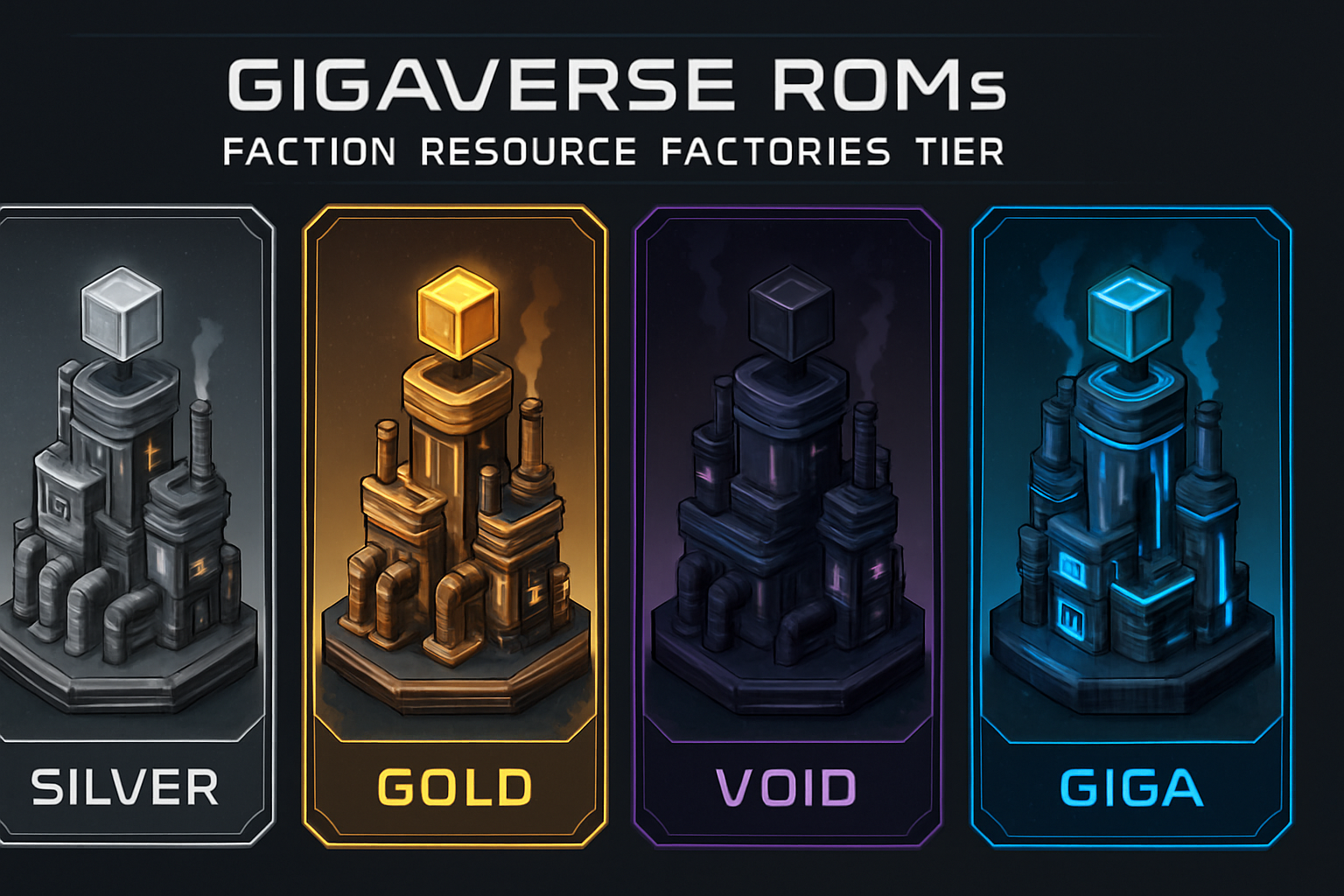

Gigaverse ROMs function as on-chain resource factories, churning out faction-aligned materials for crafting in high-stakes PvP battles. Sold out in minutes generating $1M, the 10,000-piece collection spans Silver (5,800), Gold (3,200), Void (850), and Giga (150) tiers. Each tier dictates resource output, energy boosts, and weekly drops, turning passive holdings into active gameplay accelerators.

Sold-Out Mint Signals Demand Surge in Web3 RPGs

The mint’s blistering pace underscores Gigaverse NFT performance amid broader Web3 gaming resurgence. As DappRadar notes, gaming outpaced AI dapps with a 63% momentum drop in the latter, metaverse trading hitting $6.5M. Gigaverse ROMs, held by 2,903 unique owners, boast a market cap of 899 ETH, about $2.70 million, with 24-hour volume at 4.19 ETH or $12,600. This liquidity reflects strategic accumulation, not fleeting FOMO.

Strategic holders eye ROMs for their dual role: investment and in-game edge. Daily energy boosts extend play sessions, while rare material drops fuel competitive crafting. In a sector where Yield Guild Games hails gamers as top innovators, Gigaverse proves rock-paper-scissors mechanics scaled to million-dollar empires via true ownership.

Utility Layers Fueling 79.8% Floor Price Climb

From 0.05 ETH mint to today’s 0.0899 ETH floor, approximately $270.28, ROMs exemplify Web3 gaming utility NFTs. Higher tiers amplify advantages: Giga ROMs deliver premium boosts, Void unlocks rare faction resources. This tiered utility creates a flywheel, where resource scarcity drives PvP dominance and secondary market bids.

Gigaverse ROMs NFT Tiers: Supply and Key Utilities

| Tier | Supply | Key Utility |

|---|---|---|

| Silver | 5,800 | Basic resources, standard energy |

| Gold | 3,200 | Enhanced output, moderate boosts |

| Void | 850 | Rare materials, high energy |

| Giga | 150 | Premium resources, max boosts |

MDPI research on P2E sustainability highlights token investment value and incentives; ROMs embody this with on-chain verifiability. No vaporware here, Galaxy Interactive’s roadmap echoes: post-hype breakthroughs favor projects blending RPG depth with blockchain permanence.

Strategic Edges in Player-Driven Marketplaces

NFT gaming investments 2025 pivot to assets like ROMs, where player-driven NFT marketplaces thrive on utility. DATA2073’s mobile focus pales against Gigaverse’s on-chain RPG action; ROM holders gain persistent value as ecosystems mature. Floor stability at 0.0899 ETH signals macro confidence, positioning early adopters ahead of mainstream influx. Forward-looking portfolios prioritize such hybrids, where gameplay loops reinforce tokenomics resilience.

ROMs’ outperformance stems from a utility flywheel that ATH buyers underestimated. While flippers chased mint hype, strategic accumulators locked in assets generating compounding gameplay advantages. This creates asymmetric upside: as Gigaverse’s PvP meta evolves, resource scarcity elevates high-tier ROMs, pulling floor prices higher.

Gigaverse ROMs NFTs vs. Web3 Gaming Assets: 6-Month Price Performance

Real-time comparison of Gigaverse ROMs NFT floor price against ETH, BTC, and key Web3 gaming tokens over the past six months

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Gigaverse ROMs | $270.22 | $738.15 | -63.4% |

| Ethereum (ETH) | $3,201.72 | $3,500.00 | -8.5% |

| Bitcoin (BTC) | $93,184.00 | $95,000.00 | -1.9% |

| Axie Infinity (AXS) | $1.14 | $2.91 | -60.8% |

| The Sandbox (SAND) | $0.1546 | $0.2700 | -42.7% |

| Decentraland (MANA) | $0.1623 | $0.2500 | -35.1% |

| Gala Games (GALA) | $0.007729 | $0.0200 | -61.4% |

| Immutable X (IMX) | $0.3142 | $0.7000 | -55.1% |

| Enjin Coin (ENJ) | $0.0325 | $0.0800 | -59.4% |

Analysis Summary

In a declining market over the past six months, Gigaverse ROMs NFTs floor price fell 63.4% from $738.15 to $270.22, comparable to Web3 gaming peers like Axie Infinity (-60.8%) and Gala (-61.4%), but trailing stable majors Bitcoin (-1.9%) and Ethereum (-8.5%). Despite the drop, ROMs’ utility-driven mint success (+79.8% from 0.05 ETH) underscores resilience in Web3 gaming economies.

Key Insights

- Gigaverse ROMs down 63.4%, aligning with sharp declines in gaming tokens like GALA (-61.4%) and AXS (-60.8%)

- Bitcoin and Ethereum exhibit relative stability at -1.9% and -8.5% amid broader market downturn

- Web3 gaming sector averages ~55% decline, with MANA and SAND faring better at -35.1% and -42.7%

- ROMs floor price rose 79.8% post-mint from 0.05 ETH to 0.0899 ETH, outperforming ATH buyers via utility

Data sourced exclusively from provided real-time CoinGecko prices as of 2025-12-04 (ROM: 2025-06-07). NFT floor prices in USD for Gigaverse ROMs; spot prices for tokens. Changes reflect exact 6-month performance percentages.

Data Sources:

- Main Asset: https://www.coingecko.com/en/nft/gigaverse-roms

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Axie Infinity: https://www.coingecko.com/en/coins/axie-infinity

- The Sandbox: https://www.coingecko.com/en/coins/the-sandbox

- Decentraland: https://www.coingecko.com/en/coins/decentraland

- Gala Games: https://www.coingecko.com/en/coins/gala

- Immutable X: https://www.coingecko.com/en/coins/immutable-x

- Enjin Coin: https://www.coingecko.com/en/coins/enjin-coin

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Contrast this with broader trends: Galaxy Interactive charts Web3 gaming’s winding path from hype to breakthroughs, yet few match ROMs’ post-mint trajectory. NFT Plazas’ mint coverage highlighted the $1M instant sellout; PlayToEarn touted on-chain RPG innovation. Gigaverse threads these needles, proving utility trumps narrative in sustaining Gigaverse NFT performance.

Market signals reinforce the thesis. With 2,903 owners dispersing supply across tiers, liquidity at 4.19 ETH daily volume ensures smooth entry for latecomers. Floor at 0.0899 ETH, approximately $270.28, holds firm amid volatility, market cap steady at 899 ETH or $2.70 million. This isn’t luck; it’s engineered demand from interdependent game loops.

Positioning for 2025 NFT Gaming Investments

As 2025 unfolds, NFT gaming investments 2025 sharpen focus on verifiable utility. Gigaverse ROMs lead by integrating resource gen with PvP stakes, outshining mobile-centric plays like DATA2073. Yield Guild Games’ spotlight on gamer-led innovation? Gigaverse embodies it, scaling simple mechanics into empires via blockchain permanence.

Forward thinkers stack ROMs for portfolio ballast. Silver tiers offer accessible entry for yield farming; Giga rarities suit conviction plays chasing 10x faction dominance. In player-driven NFT marketplaces, secondary trades reflect real utility pricing, not speculation. Watch for ecosystem expansions: deeper crafting trees, alliance mechanics, cross-game interoperability. These catalysts could propel floors past current 0.0899 ETH levels.

Web3 gaming’s resurgence favors projects where assets earn their keep. Gigaverse ROMs aren’t betting on revival; they’re architecting it.

Strategic allocation here means betting on macro shifts: gaming’s Web3 lead per DappRadar, sustainable P2E per MDPI. Early ROM adopters, holding through 79.8% climbs, exemplify adaptability. As metaverses mature, utility NFTs like these bridge fun and finance, rewarding those who see beyond charts to code and community.

Diversify thoughtfully: pair ROMs with ETH exposure, monitor tier distributions for arbitrage. Gigaverse’s momentum positions it as a cornerstone for Web3 RPG portfolios, where outperforming ATH buyers becomes the norm for utility-first holders. The floor at 0.0899 ETH today sets the stage for tomorrow’s gains in this evolving digital frontier.