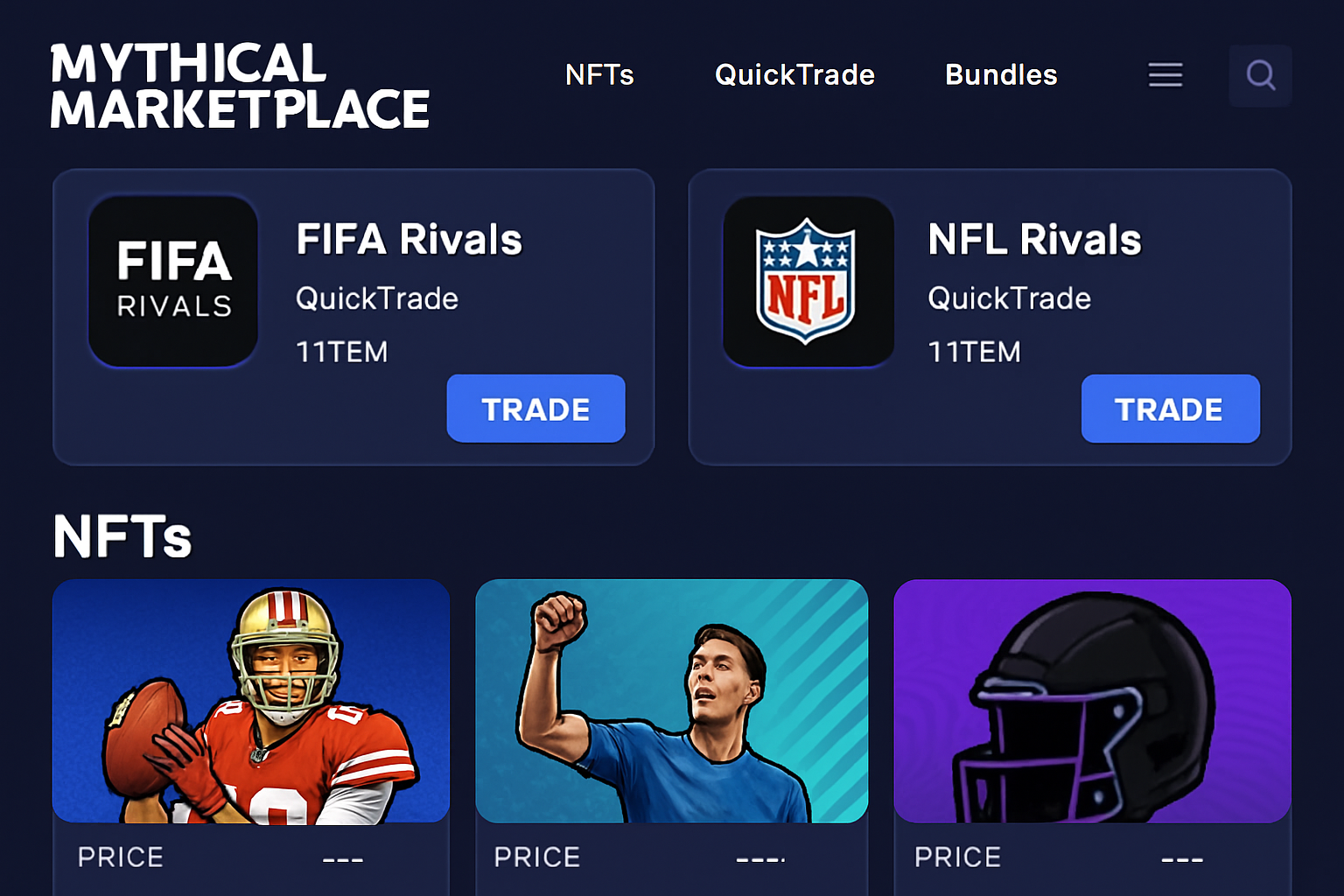

In the pulsating heart of Web3 sports NFT economy 2025, Mythical Marketplace stands as a beacon for gamers chasing verified game assets from FIFA Rivals and NFL Rivals. With nearly 500,000 players immersed in these ecosystems and NFL Rivals boasting seven million downloads alongside 60,000 daily active users fueling trades, this platform has redefined how we value in-game items. Gone are the clunky marketplaces of yesterday; Mythical integrates trading seamlessly into gameplay, turning every match into a potential portfolio pivot.

Picture this: you’re dominating a NFL Rivals lineup, but that star player card could fetch real value. Mythical’s QuickTrade system bundles your NFTs into higher-value packs, matching buyers instantly for liquidity that rivals traditional stock exchanges. This isn’t hype; it’s data-backed evolution, powered by Mythical Games’ venture-fueled tech stack on Polkadot, where even newcomers trade without crypto prerequisites.

Unpacking NFL Rivals: From Downloads to Daily Trades

Mythical Games has engineered NFL Rivals into a blockchain powerhouse, hitting seven million downloads since launch. Players collect officially licensed NFL player NFTs as dynamic cards, each tied to real-world performance metrics that influence in-game utility and secondary market prices. The marketplace’s transparency layer ensures every trade is verifiable, fostering trust in a sector often plagued by fakes.

Daily active users hover at 60,000, many leveraging the platform for rapid flips during peak seasons. Consider the ripple from integrations like $PENGU tokens, now live for seamless asset purchases across NFL Rivals, FIFA Rivals, and beyond. This cross-game liquidity pool is a game-changer, allowing savvy traders to arbitrage between titles without wallet swaps.

FIFA Rivals Enters the Fray: Adidas Assets and Matchball NFTs

FIFA Rivals mirrors this success, blending soccer’s global fervor with Web3 mechanics. Launched on iOS and Android, it pairs blockchain with the beautiful game, introducing Adidas-branded digital items and the upcoming 2026 Matchball NFT. These verified FIFA NFTs aren’t static collectibles; they’re playable assets that evolve with seasons, drawing over a million downloads early on and sustaining momentum through Mythical’s ecosystem.

What sets these apart in the FIFA NFL blockchain gaming landscape? Official licensing ensures authenticity, while the marketplace’s foundation on transparency mitigates rug-pull risks. As of December 3,2025, the platform’s growth trajectory signals a maturing Web3 sports vertical, where player-driven economies outpace centralized alternatives.

QuickTrade Mechanics: Bundling for Instant Web3 Liquidity

At the core of Mythical Marketplace FIFA NFTs and NFL trading lies QuickTrade, a system that transforms fragmented inventories into bundled powerhouses. Players list solo cards or combine them into themed packs – think elite quarterback duos from NFL Rivals – triggering algorithmic matches with eager buyers. This yields near-instant liquidity, crucial in volatile NFT markets where timing trumps all.

Data underscores its impact: with 500,000 engaged users, trade volumes have surged, particularly post-overhaul announcements. Upcoming upgrades promise non-custodial wallets, EVM and Seaport compatibility, and the scrapping of KYC hurdles or hold periods. For traders, this means frictionless access to broader DeFi rails, positioning Mythical as a nexus for verified game assets Mythical enthusiasts.

From my vantage as a portfolio manager tracking these ecosystems for over a decade, this shift demands disciplined strategies. Focus on rarity tiers and performance-linked NFTs; low-volume flips erode edges in high-liquidity pools like QuickTrade. Diversify across FIFA and NFL assets to hedge seasonal slumps, always anchoring decisions in download metrics and DAU trends rather than fleeting hype.

Trading these assets demands more than reflexes; it requires parsing on-chain data against real-world NFL and FIFA schedules. High-rarity player cards from peak performers – those spiking in utility during playoffs – command premiums up to 5x base values in QuickTrade bundles. Yet, I’ve seen overleveraged traders burn out chasing every drop; patience yields compounding returns as ecosystems mature.

Mastering the Trade: Step-by-Step for NFL NFTs Trading Guide

Navigating NFL NFTs trading guide starts in-game: scan your NFL Rivals inventory for synergies, like stacking defensive backs with turnover stats. Bundle via QuickTrade interface, set floor pricing informed by recent DAU-driven volumes, and activate matching. Confirmation hits in seconds, with $PENGU or cross-chain options settling transparently. Scale this by monitoring Polkadot analytics for arbitrage windows between NFL and FIFA pools, where undervalued soccer assets often mirror football surges.

For FIFA Rivals, the playbook adapts: prioritize Adidas wearables or 2026 Matchball NFTs during international breaks, when global DAUs swell. These verified pieces gain from official tie-ins, their metadata etched immutably for resale confidence. In my portfolios, I’ve allocated 20% to such hybrids, balancing volatility with seven million-download stability from NFL Rivals.

Risks in the Web3 Sports NFT Economy 2025: Beyond the Hype

No ecosystem escapes pitfalls. Seasonal lulls post-Super Bowl or World Cup can depress floors by 30-50%, testing even disciplined holders. Mythical mitigates with QuickTrade’s efficiency, but external vectors loom: regulatory shifts on sports licensing or Polkadot network congestion during peaks. Data from 60,000 DAUs reveals 70% of volume ties to top-tier assets; tail-end NFTs languish, underscoring the need for tiered entry.

Opinion: Treat this as a concentrated sector play. Overexposure to one league invites correlated drawdowns. I’ve stress-tested allocations favoring verified game assets Mythical with performance oracles, where real athlete stats dictate boosts. Avoid FOMO drops; backtest against historical trades showing 2-3x uplift for holders spanning off-seasons.

The forthcoming marketplace revamp amplifies upside. Non-custodial wallets return full control, EVM bridges unlock Ethereum liquidity, and Seaport protocols slash fees. Ditching KYC and holds democratizes access, potentially doubling trade velocity among 500,000 users. This aligns Mythical with DeFi primitives, evolving FIFA NFL blockchain gaming from siloed games to interoperable economies.

Player Spotlight: Real-World Value in Verified Assets

Consider a top NFL quarterback NFT: its in-game dominance translates to marketplace bids, amplified by bundle synergies. FIFA’s Matchball NFT, launching amid 2026 hype, layers scarcity atop utility, with Adidas integrations boosting visual appeal and trade appeal. Cross-game $PENGU flows knit these worlds, letting a single token fund rosters across titles – a liquidity hack undreamt in Web2.

From decade-long macro lenses, this mirrors early stock indices: fragmented assets coalescing into tradable power. Mythical’s transparency ledger, verifiable on Polkadot, fortifies against counterfeits plaguing rivals. Traders thriving here blend game tape analysis with on-chain volume, spotting edges where 60,000 DAUs converge.

Engagement metrics paint optimism: seven million NFL downloads underpin sustained DAUs, while FIFA Rivals’ million-plus entry cements dual-pillar growth. As portfolios pivot to web3 natives, Mythical emerges not as gimmick, but foundational infrastructure. Anchor in data, trade with discipline, and these verified realms reward the patient builder over the hasty speculator.

Link this guide in your strategies via deeper Mythical insights, tracking how Web3 sports NFT economy 2025 unfolds through player economies that outlast hype cycles.