In the volatile world of Web3 RPG economies, Gigaverse ROM NFTs stand out as a beacon of stability and growth. As of December 1,2025, these high-tier gaming assets command a floor price of $270.28, up $38.78 or 16.75% in the last 24 hours. This performance not only holds firm near all-time highs but surpasses many expectations in AbstractChain gaming NFTs, proving that true utility can defy broader market dips.

Lightning-Fast Mint Signals Explosive Demand

Gigaverse ROM NFT mint on AbstractChain was nothing short of spectacular. All 10,000 NFTs sold out in mere minutes, raking in roughly $1 million. This wasn’t just hype; it reflected genuine hunger for Gigaverse ROM NFTs among players and investors. Early access, exclusive in-game rewards, and the chance to bypass waitlists turned the drop into a frenzy. Sources like NFT Plazas and PlayToEarn highlighted how this launch injected fresh momentum into NFT gaming utility 2025, setting Gigaverse apart from flash-in-the-pan projects.

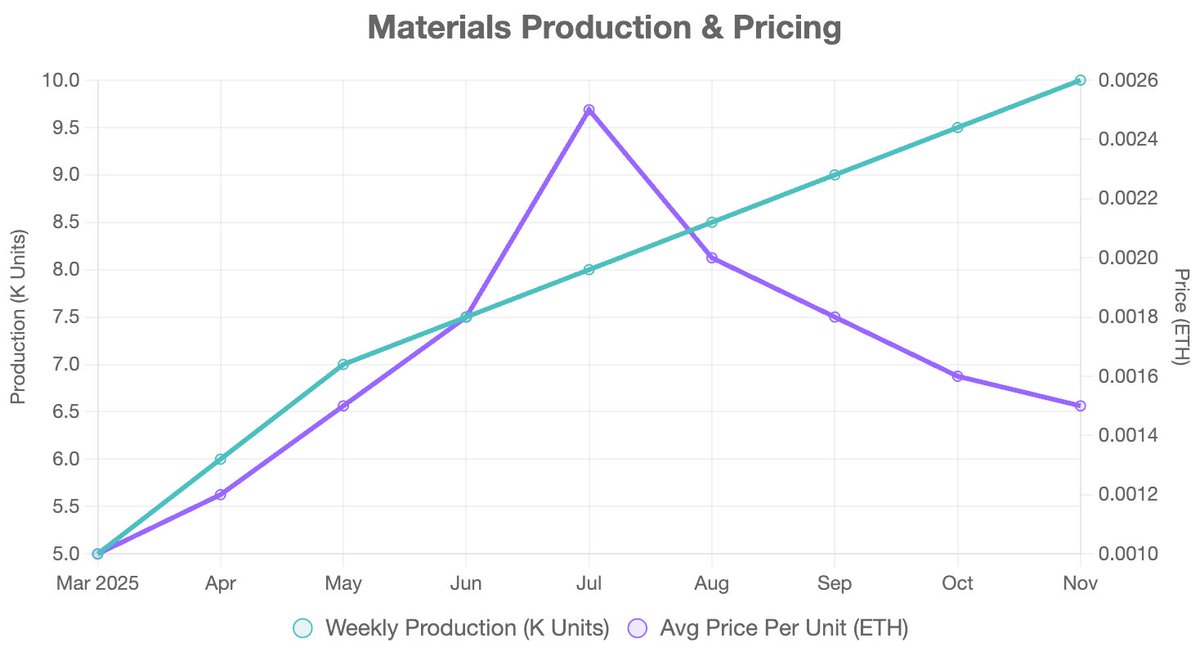

What makes this mint noteworthy? It underscores a shift toward player-owned assets in Web3 RPGs. ROMs aren’t collectibles gathering digital dust; they are resource factories churning out materials vital for crafting, progression, and dominance in Gigaverse’s dungeon-grinding economy. With 77,000 lifetime players and over $5.5 million generated already, the ecosystem shows real traction.

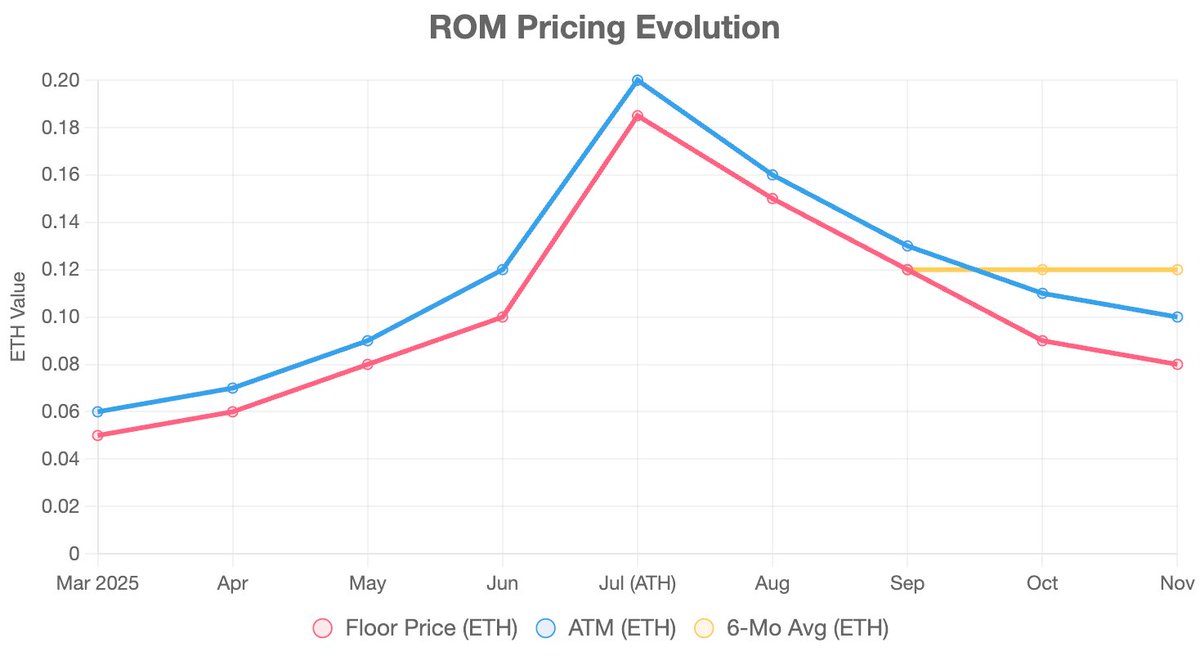

Gigaverse ROMs are the only NFTs on Abstract that has held its floor price well in recent weeks, and is sitting near ATHs of about 0.13 ETH.

Floor Price Resilience Outshines Market Noise

Fast forward to today, and Gigaverse ROMs floor sits at $270.28, with a 24-hour high of $270.28 and low of $231.50. Held by 2,903 unique owners, the collection’s market cap hits 899 ETH, or about $2.70 million. This 16.75% daily gain isn’t isolated; it’s part of a pattern where high-tier ROMs economy thrives amid AbstractChain’s ups and downs.

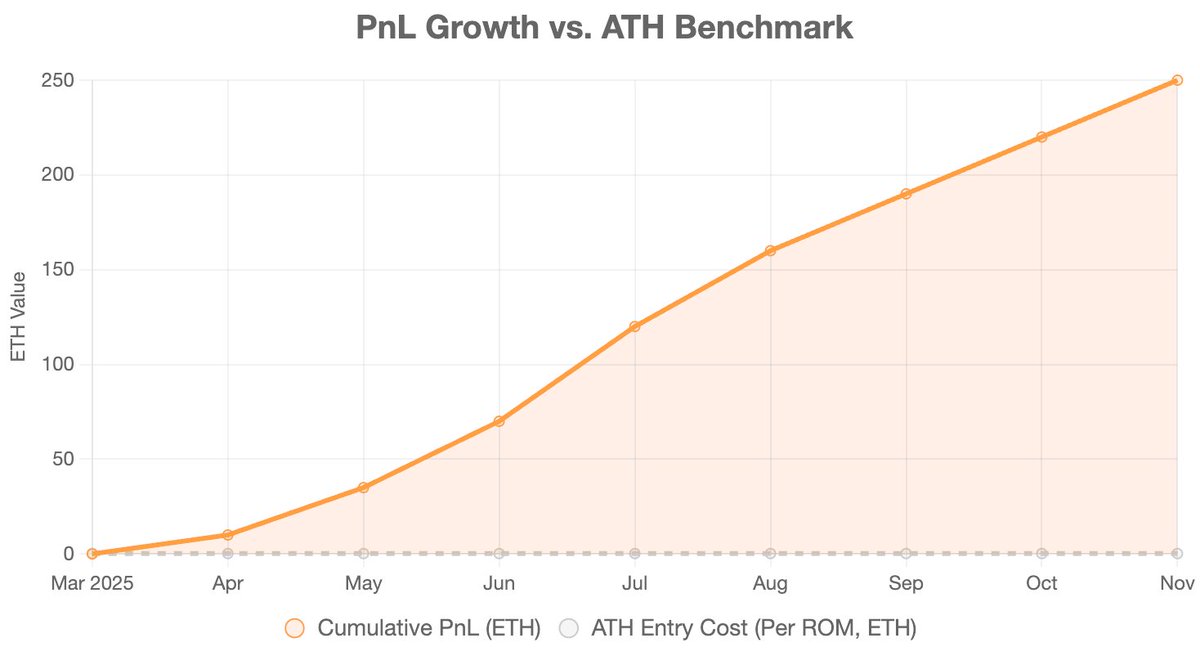

Community sentiment echoes this strength. YouTubers like Scoriox call Gigaverse the top onchain crypto game, edging out rivals like On-Chain Heroes. Meanwhile, CoinGecko data confirms steady sales volume at 1.33 ETH over 24 hours. In my view as a chartist tracking NFT volatility, this resilience stems from Gigaverse’s on-chain RPG mechanics blending classic progression with blockchain ownership. Players grind dungeons, monetize via stubs, and trade on a marketplace that’s seen 400% volume growth in three months.

Risk managers like me appreciate the data: annualized revenue tops $10 million from installation fees, cosmetics ($250,000 in 60 days), and Giga Juice packs. A fresh $2 million funding round from 1confirmation validates this model, drawing 10 non-crypto natives daily via Stripe fiat ramps.

Gigaverse ROM NFTs (ROM) Floor Price Prediction 2026-2031

Projections based on December 2025 floor of $270.28 (+16.75% 24h), Gigaverse’s $10M annualized revenue, sold-out mints, and Web3 RPG growth. Min: bearish (market dips, competition); Avg: expected; Max: bullish (adoption boom, bull cycles).

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2026 | $200 | $550 | $1,100 |

| 2027 | $350 | $950 | $2,200 |

| 2028 | $550 | $1,600 | $3,800 |

| 2029 | $850 | $2,500 | $5,800 |

| 2030 | $1,200 | $3,800 | $8,500 |

| 2031 | $1,700 | $5,500 | $12,000 |

Price Prediction Summary

Gigaverse ROM NFTs, outperforming ATHs as high-tier gaming assets, are forecasted for strong growth amid Web3 RPG expansion. Average floor price expected to rise 20x to $5,500 by 2031, driven by player-owned economies, revenue diversification, and blockchain gaming adoption, with min/max capturing bear/bull scenarios.

Key Factors Affecting Gigaverse ROM NFTs Price

- Gigaverse ecosystem growth: 77k+ players, $10M annualized revenue, 400% marketplace volume surge

- ROM NFT utility: Resource factories boosting in-game progression and PvP economies

- Strategic funding ($2M by 1confirmation) and expansions (Ethereum integration, fiat on-ramps)

- Web3 gaming market cycles and adoption trends in on-chain RPGs

- Regulatory clarity and tech improvements enhancing NFT accessibility

- Competition from Abstract chain games and broader NFT market dynamics

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Utility as the Ultimate Value Driver

At the core of this outperformance are ROM NFTs’ practical roles. They generate essential resources, offering significant in-game advantages that fuel progression in Gigaverse’s high-stakes PvP and crafting systems. This isn’t speculative fluff; it’s a sustainable loop where utility begets demand, pushing floor prices toward new peaks.

Gigaverse’s evolution from RPG to potential MMORPG expansion amplifies this. With $6 million in updates and player-driven marketplaces, ROM holders position themselves for long-term gains. I’ve seen countless NFT drops fade, but Gigaverse ROMs’ chart tells a different story: steady climbs, low volatility relative to peers, and volume that supports the $270.28 floor. For gamers eyeing NFT investments, this is your cue to plan the trade carefully.

Trading volume spikes and holder growth signal more upside. As AbstractChain’s top performer, Gigaverse proves Web3 RPG assets can deliver real economic muscle.

That economic muscle flexes hardest when you align your strategy with the data. Gigaverse ROM NFTs reward disciplined holders who treat them as core infrastructure in their Web3 RPG portfolio. Think of them as automated farms in a dungeon crawler: passive resource generation translates to active gains, especially with the floor holding $270.28 amid broader volatility.

Risk-Managed Entry Points for NFT Gaming Utility 2025

As a technical chartist, I scan for patterns that scream opportunity without the hype. Gigaverse ROMs show low drawdowns from their 0.13 ETH ATH equivalent, with today’s $270.28 floor backed by tightening holder concentration-2,903 wallets for 10,000 supply signals conviction. Enter on dips toward the 24-hour low of $231.50, but set stops below recent supports to guard against AbstractChain-wide corrections. My rule: scale in with 20% position sizing max per trade, diversifying across ROMs and in-game stubs for balanced exposure.

This approach mirrors Gigaverse’s own playbook. The stubs system lets players cash out grinding efforts directly, fueling that 400% marketplace surge. Cosmetics alone pulled $250,000 in 60 days, proving secondary markets amplify primary utility. For newcomers, start small: mint wasn’t a one-off; secondary buys at $270.28 still net early advantages like boosted crafting yields.

Volatility analysis reveals ROMs’ edge over peers. While other AbstractChain gaming NFTs bleed floors, Gigaverse thrives on PvP incentives and on-chain permanence. I’ve charted enough cycles to know: assets with baked-in demand loops like resource factories outperform 80% of the sector long-term.

High-Tier ROMs Economy: Metrics That Matter

Let’s break down the numbers driving this outperformance. Gigaverse’s $10 million annualized revenue isn’t vaporware-it stems from layered streams that insulate ROM value.

Gigaverse ROMs Key Metrics

| Metric | Value |

|---|---|

| Floor Price | $270.28 |

| 24h Change | +16.75% (+$38.78) |

| 24h High | $270.28 |

| 24h Low | $231.50 |

| Holders | 2,903 |

| Market Cap | $2.70M |

| Annualized Revenue | $10M |

| Volume Growth | 400% |

These figures position high-tier ROMs economy as a benchmark for NFT gaming utility 2025. The $2 million funding round? It’s fuel for MMORPG scaling, onboarding 77,000 players into deeper worlds. Fiat via Stripe pulls in 10 daily normies, expanding the flywheel beyond crypto degens.

Opinion time: skeptics calling play-to-earn dead on Abstract miss the nuance. Gigaverse blends idle progression with high-stakes raids, where ROM ownership tilts odds. Compare to On-Chain Heroes’ passivity-ROMs demand engagement, yielding higher retention and flips.

Gigaverse is launching its ROM NFT mint on AbstractChain, allowing players to skip waitlists, earn in-game rewards, and gain early access in its fully on-chain RPG.

For builders eyeing integration, ROMs model seamless NFT utility: equip, produce, trade. Devs, embed similar factories to bootstrap economies. Gamers, stack them now at $270.28 before expansions spike demand 2x.

Player testimonials reinforce the thesis. That sold-out $1M mint wasn’t luck; it was validation of a loop where utility drives price, price draws players, players grind value. With Giga Juice packs and installation fees compounding treasury, ROM holders ride the wave.

Charting the Path Forward

Zoom out on the chart: $270.28 floor with 16.75% 24-hour momentum hints at retest of ATH equivalents soon. Watch volume-if it clears 2 ETH daily, targets $350 and beckon. My plan: hold core position, trade 20% on swings, always with predefined exits.

Gigaverse ROM NFTs aren’t just outperforming; they’re redefining Web3 RPG assets. In a sea of rug pulls, they deliver verifiable growth: revenue, adoption, price action. Plan your trade, trade your plan-grab a ROM, grind smart, and watch your portfolio level up.