In the accelerating NFT-driven economies of 2025, Solana’s gaming sector stands out as a high-conviction play for forward-thinking collectors. The Play Strategic Reserve exemplifies disciplined NFT accumulation gaming strategy, amassing Player1 and Player2 NFTs to anchor portfolios amid rising SOL prices at $137.69. This approach signals institutional-grade commitment to Play Solana’s ecosystem, positioning holders for token airdrops and metaverse expansions.

Decoding the Play Strategic Reserve’s Holdings

The Play Strategic Reserve has quietly built a formidable position since mints began. Recent data reveals accumulations of 100 Player1 NFTs and 340 Player2 NFTs, with some trackers noting over 500 Player2 units, underscoring a bullish stance on core IP. Play Solana, pioneering the first gaming console on Solana, leverages this reserve to demonstrate long-term faith in its blockchain-native hardware and software stack.

Player2 NFTs, capped at 8,000 total supply, launched in June 2025 with claims open to Player1 holders, PSG1 presale participants, and whitelisted community members. Both series accrue experience points equally within the Play Solana game, unlocking future PLAY token distributions and token generation events. At SOL’s current $137.69 perch, up 0.0138% intraday from a $135.32 low, these assets offer asymmetric upside as Solana’s TVL and user base swell.

This reserve mirrors broader trends, akin to SOL Strategies’ Strategic Ecosystem Reserve acquiring 52,181 JTO tokens to bolster MEV infrastructure. Yet Play’s focus on gaming primitives sets it apart, gamifying discovery via Player2’s directory platform for Solana projects.

Player1 and Player2: Pillars of Solana NFT Gaming Portfolios

Player1 NFTs represent foundational avatars in Play Solana’s universe, while Player2 extends utility as a gamified explorer for ecosystem projects. Holders gain dual exposure: in-game progression and passive rewards from PLAY tokenomics. With Solana hosting top 2025 titles like STEPN and Star Atlas, these NFTs bridge play-to-earn mechanics with strategic holding.

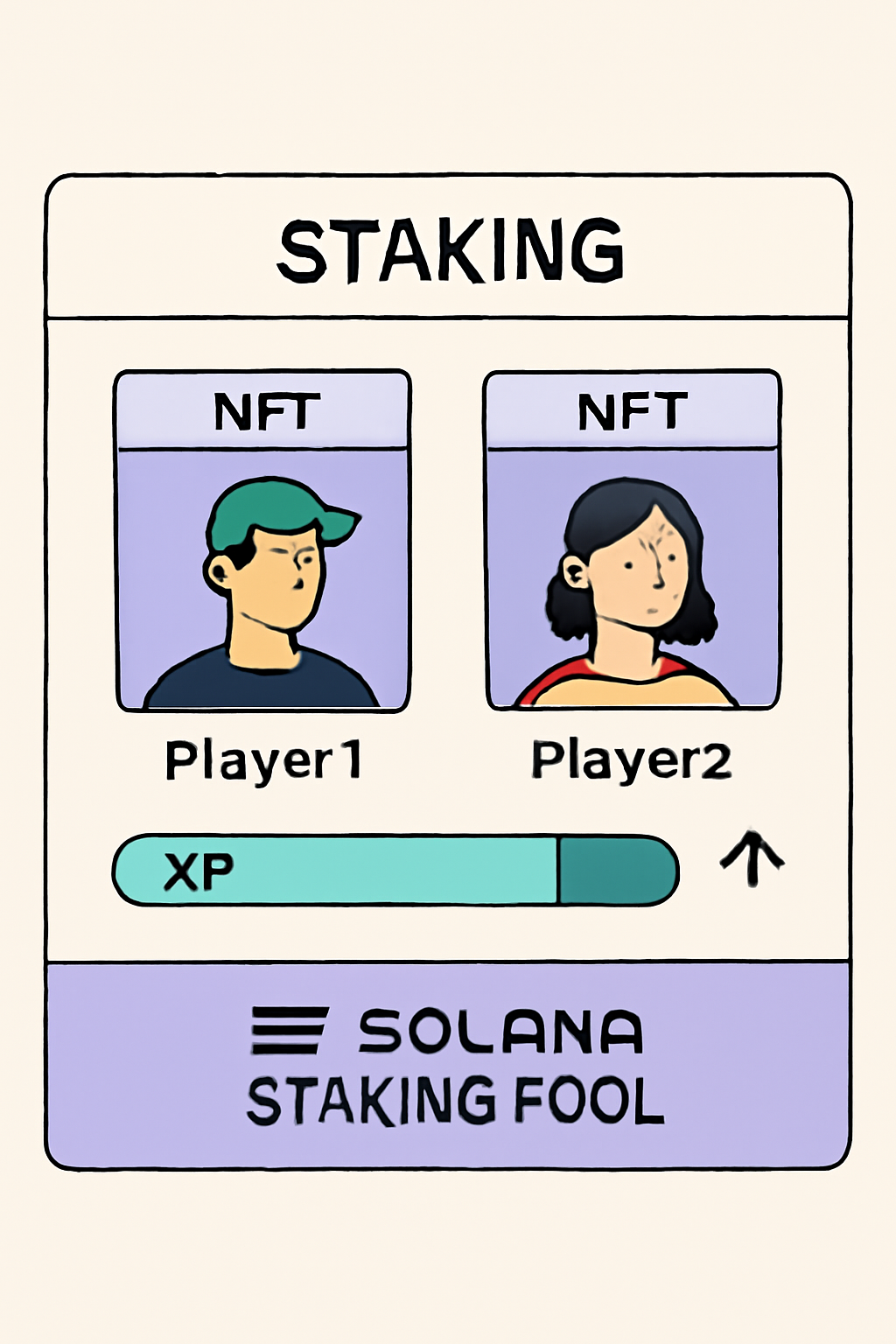

Strategic accumulation here isn’t speculative flipping; it’s about stacking Player1 Player2 NFTs Solana for compounded yields. Both earn XP at identical rates, ensuring parity in airdrop eligibility. As SOL holds $137.69 amid a $139.92 high, portfolio builders target entry below key supports, eyeing network upgrades that amplify NFT utilities.

| NFT Series | Accumulated by Reserve | Total Supply | Key Utility |

|---|---|---|---|

| Player1 | 100 and | Limited | Game Avatars and XP |

| Player2 | 340-500 and | 8,000 | Directory Access and XP |

This table highlights the reserve’s selective buildup, prioritizing quality over quantity in Solana NFT gaming portfolios.

Crafting Your 2025 Accumulation Blueprint

Forward-looking builders allocate 20-30% of Solana exposure to Play Strategic Reserve-inspired holdings. Start with Player1 for core positioning, then layer Player2 via claims or secondary markets. Monitor on-chain flows; reserves like this presage retail FOMO as PLAY console integrations deepen.

Solana (SOL) Price Prediction 2026-2031

Forecasts driven by Play Solana gaming expansions, strategic NFT reserves (Player1/Player2 accumulation), and ecosystem TVL growth from current $137.69 baseline

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $180 | $280 | $450 |

| 2027 | $250 | $420 | $700 |

| 2028 | $350 | $600 | $950 |

| 2029 | $450 | $800 | $1,300 |

| 2030 | $600 | $1,050 | $1,700 |

| 2031 | $800 | $1,350 | $2,200 |

Price Prediction Summary

Solana (SOL) is positioned for strong growth from 2026-2031, fueled by gaming NFT adoption (e.g., Play Solana’s 8,000 Player2 NFTs and reserves holding 100+ Player1/500+ Player2), institutional strategies like SOL Strategies’ SER, and Solana’s gaming edge. Average price could climb 4.8x to $1,350 by 2031, with bull highs over $2,000 amid market cycles.

Key Factors Affecting Solana Price

- Gaming NFT TVL surge from Play Solana expansions and Player1/Player2 rewards

- Strategic reserves accumulation signaling institutional commitment

- Solana’s scalability advantages for blockchain games (e.g., STEPN, Star Atlas)

- MEV/liquid staking growth (Jito TVL $2.6B) and infrastructure upgrades

- Crypto market cycles with post-2025 recovery and adoption

- Regulatory tailwinds and competition dynamics vs. Ethereum L2s

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

At $137.69, SOL’s momentum favors patient stacking. Pair with staking JTO or ecosystem plays, but anchor in Player NFTs for genre-specific alpha. Risks include mint dilution, yet capped supplies and reserve backing mitigate this. Next, we dissect execution tactics and risk-adjusted models.

Execution begins with disciplined entry points, leveraging SOL’s stability at $137.69 to acquire Player1 and Player2 without overpaying. Target secondary markets during dips below $135.32 intraday lows, where liquidity pools thicken. Reserves like Play’s signal optimal timing; their 100 Player1 and 340 and Player2 holdings reflect value averaging over months, not days.

Step-by-Step Blueprint for Dual-Portfolio Construction

Player1 portfolios prioritize avatar depth: stack 5-15 units for in-game leadership roles, where XP compounds into governance votes. Player2 suits explorers, blending directory access with passive yields; aim for 10-20 to gamify Solana project scouting. This bifurcation maximizes NFT accumulation gaming strategy, splitting risk across core IP and ecosystem plays.

Integrate with Solana’s 2025 catalysts, like console rollouts and metaverse bridges. Play Solana’s 8,000 Player2 cap ensures scarcity, while equal XP accrual democratizes rewards. At $137.69, every Player NFT doubles as a leveraged SOL bet, amplified by network TVL chasing $10 billion thresholds.

Risk-Adjusted Portfolio Calibration

Calibrate aggressively yet prudently. Allocate 15% to Player1 for high-conviction bets, 10% to Player2 for breadth, reserving 5% cash for opportunistic claims. Volatility models favor this: SOL’s 0.0138% 24-hour gain masks beta to gaming TVL, where Play leads. Hedge via JTO staking, echoing SOL Strategies’ 52,181-token reserve, but tilt toward NFTs for alpha decay resistance.

Stress-test against black swans; mint floods hit 20% of Solana NFT floors historically, yet Play’s whitelist gates dilution. Opinion: Player2’s directory utility weathers bear phases better than pure PFPs, offering real-time project intel amid 2025’s 500 and game launches.

| Portfolio Tier | Player1 Alloc. | Player2 Alloc. | Expected 2025 Yield (SOL $137.69 Base) |

|---|---|---|---|

| Conservative | 5 NFTs | 10 NFTs | 2-3x via XP/PLAY |

| Aggressive | 15 NFTs | 25 NFTs | 5x and on metaverse |

| Reserve-Mimic | 100 NFTs | 340 NFTs | Institutional 10x |

These tiers benchmark against Play Strategic Reserve’s stack, scaling for retail builders. Yields project from XP parity and tokenomics, assuming SOL climbs on gaming inflows.

Macro tailwinds solidify this: Solana’s speed crushes Ethereum L2s for real-time gaming, with titles like Star Atlas validating NFT primitives. Play Solana’s console fuses hardware conviction, turning Player NFTs into hardware-software hybrids. Forward thinkers front-run this, accumulating before retail floods secondary markets.

By Q4 2025, expect PLAY distributions to catalyze 3-5x floors, propelled by $137.69 SOL’s breakout potential. Player1 anchors loyalty; Player2 unlocks discovery edges in NFT driven economies 2025. Build now, as reserves dictate: quality holdings trump volume in Solana’s player-owned future.