Virtual land ownership is no longer a futuristic concept. Thanks to play-to-earn NFT games, it’s a thriving reality where gamers and investors alike can buy, develop, and profit from digital real estate. The rise of blockchain-powered metaverses has created dynamic marketplaces for NFT land, blending the thrill of gaming with the strategic depth of property investment. In 2024, platforms like Decentraland, The Sandbox, My Neighbor Alice, and NFT Worlds are at the forefront of this revolution – each offering unique opportunities to monetize virtual land and participate in rapidly growing digital economies.

Decentraland (MANA): Pioneering NFT Land Ownership

Decentraland stands as a flagship example of how play-to-earn NFT games are transforming the concept of property. Built on Ethereum, Decentraland lets users purchase parcels of virtual land as NFTs. Each plot measures 16×16 meters and can be customized with anything from art galleries to interactive experiences. The platform’s native token, MANA, fuels its economy – enabling purchases, upgrades, and participation in governance.

The active marketplace in Decentraland has witnessed record-breaking sales (such as the $2.43 million plot acquisition by a virtual real estate company), illustrating how digital land can rival physical property in value. Landowners generate revenue by hosting events, leasing space for advertising or retail pop-ups, or developing attractions that draw paying visitors. Community-driven festivals and live performances further drive up land values by increasing foot traffic and visibility.

For more on Decentraland’s economic model and user-driven events, check out this detailed guide.

The Sandbox (SAND): Building and Monetizing Voxel-Based Worlds

The Sandbox offers another compelling avenue for NFT-based virtual land ownership. This voxel-style metaverse empowers users to buy LAND tokens – each representing a unique plot on its expansive map. Players use intuitive tools like VoxEdit and Game Maker to create assets or design interactive experiences directly on their LAND.

What sets The Sandbox apart is its robust monetization toolkit:

- Staking SAND: Earn passive income by locking up your SAND tokens.

- LAND Renting: Lease plots to developers or creators looking to launch experiences without buying their own land.

- User-generated Content: Build games or social hubs that attract players – then charge entry fees or sell digital goods.

The platform’s thriving creator economy means savvy investors can flip undervalued plots or establish long-term revenue streams by supporting high-traffic projects. As with Decentraland, all assets are secured as NFTs on-chain for verifiable ownership.

Decentraland vs The Sandbox: Key Features for Land Investors

-

Decentraland (MANA): A leading virtual world platform on Ethereum, Decentraland lets users purchase, develop, and monetize NFT-based virtual land parcels. Investors benefit from an active marketplace, customizable land, and community-driven events that can drive land value and generate revenue through experiences, advertising, and rentals.

-

The Sandbox (SAND): This voxel-based metaverse enables players to buy, build, and trade NFT land and assets. Unique features for investors include LAND staking for passive SAND income, the ability to rent out plots, and hosting play-to-earn experiences using in-platform tools like VoxEdit and Game Maker.

-

My Neighbor Alice: A farming-themed play-to-earn game where players can acquire, upgrade, and monetize virtual plots. Investors can grow crops, build structures, and participate in community events to boost land value and earn rewards, blending casual gameplay with land ownership.

-

NFT Worlds: A Minecraft-compatible metaverse where NFT landowners can create custom play-to-earn games or lease their worlds to developers for passive WRLD token income. This platform offers flexibility for investors to monetize land through both development and leasing strategies.

-

Land Flipping & Rental Strategies: Beyond holding, investors can maximize returns by actively trading undervalued NFT land parcels across platforms or renting out owned plots for yield generation as the metaverse economy expands. These strategies leverage market trends and platform growth for potential passive income.

My Neighbor Alice: Farming Meets Play-to-Earn Real Estate

If you prefer a more casual approach to NFT land ownership, My Neighbor Alice combines social gaming with property management in a whimsical farming world. Players acquire plots as NFTs that they can upgrade with crops, decorations, and buildings. By participating in seasonal events or collaborating with neighbors on shared projects, users can unlock new resources and increase the value of their holdings.

This game rewards both active participation (through farming competitions) and passive strategies (by renting out developed plots). Its approachable design makes it ideal for newcomers exploring the intersection of gaming and digital asset investment.

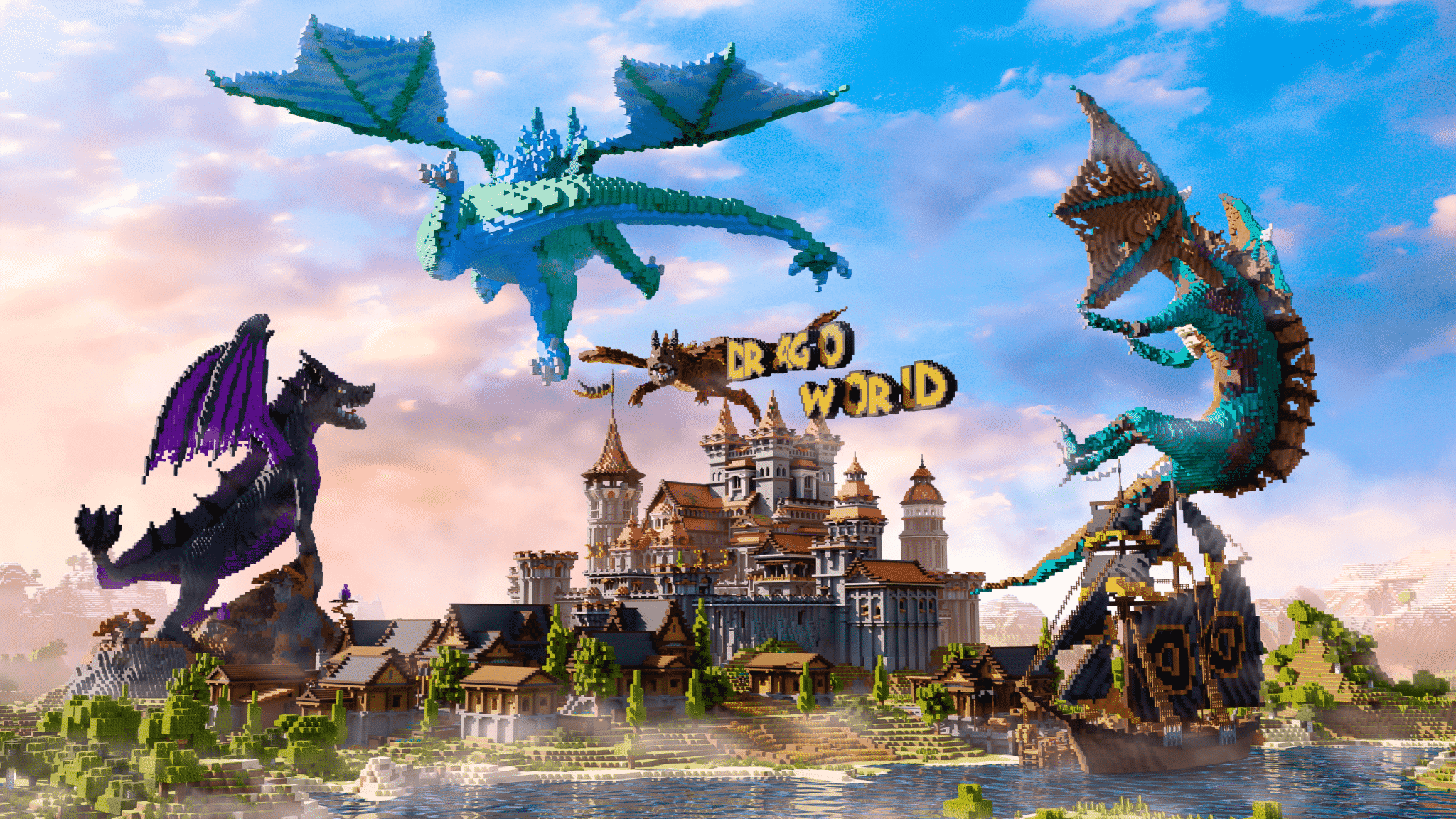

NFT Worlds and Advanced Land Strategies

NFT Worlds takes interoperability even further by integrating with Minecraft’s vast ecosystem. Here, each world is an NFT parcel that owners can develop into custom play-to-earn experiences or lease out to third-party game developers for ongoing WRLD token income. This flexibility opens doors for creative entrepreneurs who want to build mini-games or social hubs without coding from scratch.

Active traders also employ sophisticated strategies like flipping undervalued lands across multiple platforms or renting out prime locations as demand surges during major events.

As the NFT gaming economy matures, maximizing returns from virtual land requires both strategic foresight and a willingness to adapt. Platforms like NFT Worlds reward those who innovate: owners can set up their own play-to-earn games, establish exclusive communities, or simply lease their digital real estate to ambitious builders seeking a ready-made audience. The ability to generate passive income through WRLD token payouts makes NFT Worlds especially attractive for investors with a long-term outlook.

Beyond building and holding, land flipping and rental strategies have emerged as some of the most lucrative tactics in the NFT land marketplace. Savvy participants scour listings for undervalued parcels, often in up-and-coming districts or near popular event spaces, then resell them at a premium as demand rises. Others deploy their holdings into rental pools, earning steady yield as developers or event organizers seek temporary access to high-traffic locations.

Key Strategies for Monetizing Virtual Land in Play-to-Earn NFT Games

The opportunities for monetizing virtual land are more diverse than ever before. Here are some proven strategies embraced by top players across Decentraland, The Sandbox, My Neighbor Alice, and NFT Worlds:

Top Platforms & Strategies for Virtual Land Success

-

Decentraland (MANA): Leading virtual world platform where users can purchase, develop, and monetize NFT-based virtual land parcels. Decentraland features an active marketplace and frequent community events, driving land value and offering opportunities for hosting experiences, advertising, and renting out parcels.

-

The Sandbox (SAND): A voxel-based metaverse allowing players to buy, build, and trade NFT land and assets. The Sandbox offers passive income through LAND staking, renting, and hosting play-to-earn experiences, all powered by its native SAND token.

-

My Neighbor Alice: Farming-themed play-to-earn game enabling players to acquire, upgrade, and monetize virtual plots of land. Users can grow crops, build structures, and participate in community-driven events for rewards and increased land value.

-

NFT Worlds: Minecraft-compatible metaverse where NFT landowners can create custom play-to-earn games or lease their worlds to developers. This enables passive income in WRLD tokens and supports a wide range of user-generated content and monetization models.

-

Land Flipping & Rental Strategies: Actively trading undervalued NFT land parcels across multiple platforms or renting out owned plots for yield generation. As the metaverse economy grows, these strategies can maximize returns and diversify passive income streams.

1. Host Events and Experiences: Whether it’s an art exhibition in Decentraland or a music festival in The Sandbox, unique events drive foot traffic and boost land value. Owners can charge entry fees, sell digital merchandise, or attract sponsorships.

2. Develop Play-to-Earn Mini-Games: In platforms like NFT Worlds and The Sandbox, custom-built games can reward visitors with tokens while generating revenue for landowners through participation fees or ad placements.

3. Rent Out Prime Locations: As seen in My Neighbor Alice and The Sandbox, developed plots in desirable areas can be leased to creators or brands looking to tap into established communities without purchasing land outright.

4. Flip Undervalued Parcels: Active traders monitor marketplace trends and capitalize on price swings by buying low and selling high, especially during periods of heightened activity such as platform updates or major collaborations.

5. Stake Platform Tokens: Staking mechanisms (like SAND staking) let owners earn passive rewards simply by participating in the network’s growth while holding onto their assets long-term.

The Future of Virtual Land Ownership

The integration of NFTs into play-to-earn games has fundamentally redefined what it means to own property online. No longer limited to cosmetic bragging rights, today’s virtual parcels are programmable assets, capable of hosting businesses, generating yield, and fostering vibrant communities. As mainstream adoption accelerates and new platforms emerge, expect more sophisticated monetization models (such as dynamic rental agreements or decentralized autonomous organizations managing communal lands) to shape the next wave of growth.

If you’re considering entering this space, or looking to expand your existing portfolio, focus on platforms with active user bases and robust creator economies like The Sandbox, Decentraland, My Neighbor Alice, and NFT Worlds. Each offers distinct advantages depending on your risk tolerance and creative ambitions.

The convergence of gaming culture with blockchain technology has created a new class of digital landlords, where community engagement is just as important as location. The best opportunities lie not just in speculation but in building experiences that keep players coming back for more.