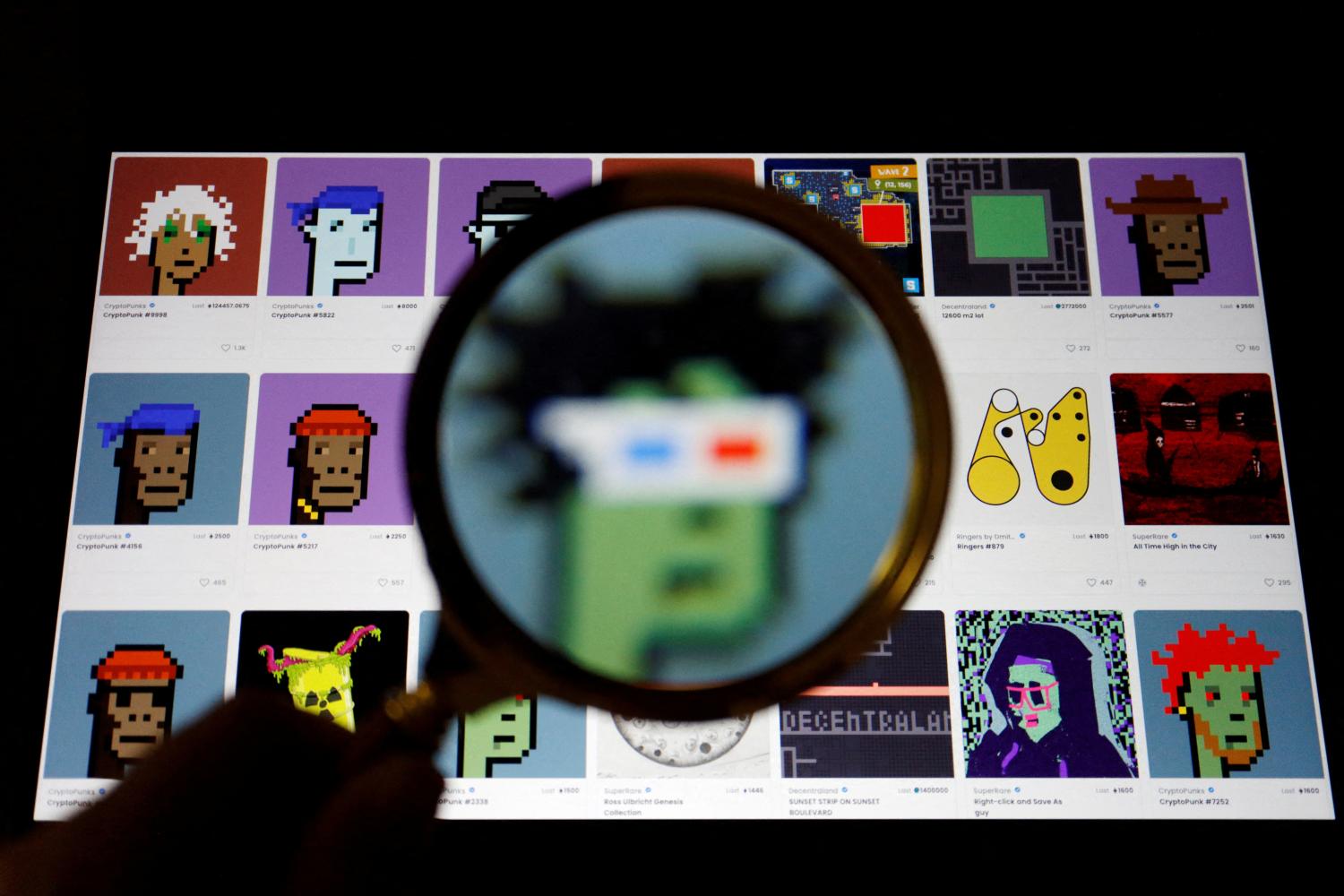

Imagine being able to turn your favorite in-game sword, rare character skin, or virtual plot of land into a steady stream of income – all while keeping ownership. That’s the new reality in NFT renting games, where players are unlocking fresh ways to profit by lending their digital assets. As the NFT gaming landscape matures in 2025, renting NFTs for profit has become a cornerstone of the player-driven economy, benefitting both asset owners and gamers eager for premium experiences without hefty upfront costs.

How NFT Renting Works: Earning While You Play (or Don’t)

At its core, NFT renting lets you lend out your digital gaming assets – think legendary weapons, rare skins, or exclusive avatars – to other players for a set period. The renter pays a fee for temporary access, while you retain full ownership and can recall your item once the rental expires. This model is flourishing thanks to platforms like LootRush, which supports rentals across 1,000 and games and multiple blockchains. LootRush’s two-sided marketplace makes it easy for owners to list NFTs and for gamers to browse affordable rental options.

But it’s not just about accessibility; it’s about passive income. According to Techlasi, NFT holders can monetize assets they aren’t actively using, maximizing value and liquidity within their portfolios. This is especially powerful in games where high-demand items are prohibitively expensive or hard to obtain through gameplay alone.

“The biggest benefit for gaming NFT holders is the ability to earn income on their in-game assets by renting them to other players. ”

– Chainlink

Key Platforms Revolutionizing Game Asset Rentals

Top NFT Rental Platforms in Blockchain Gaming

-

LootRush: A leading NFT rental marketplace supporting over 1,000 blockchain games. LootRush enables owners to earn passive income by lending NFTs, while gamers access premium assets affordably. Its custodial and non-custodial options offer flexibility and security. Learn more

-

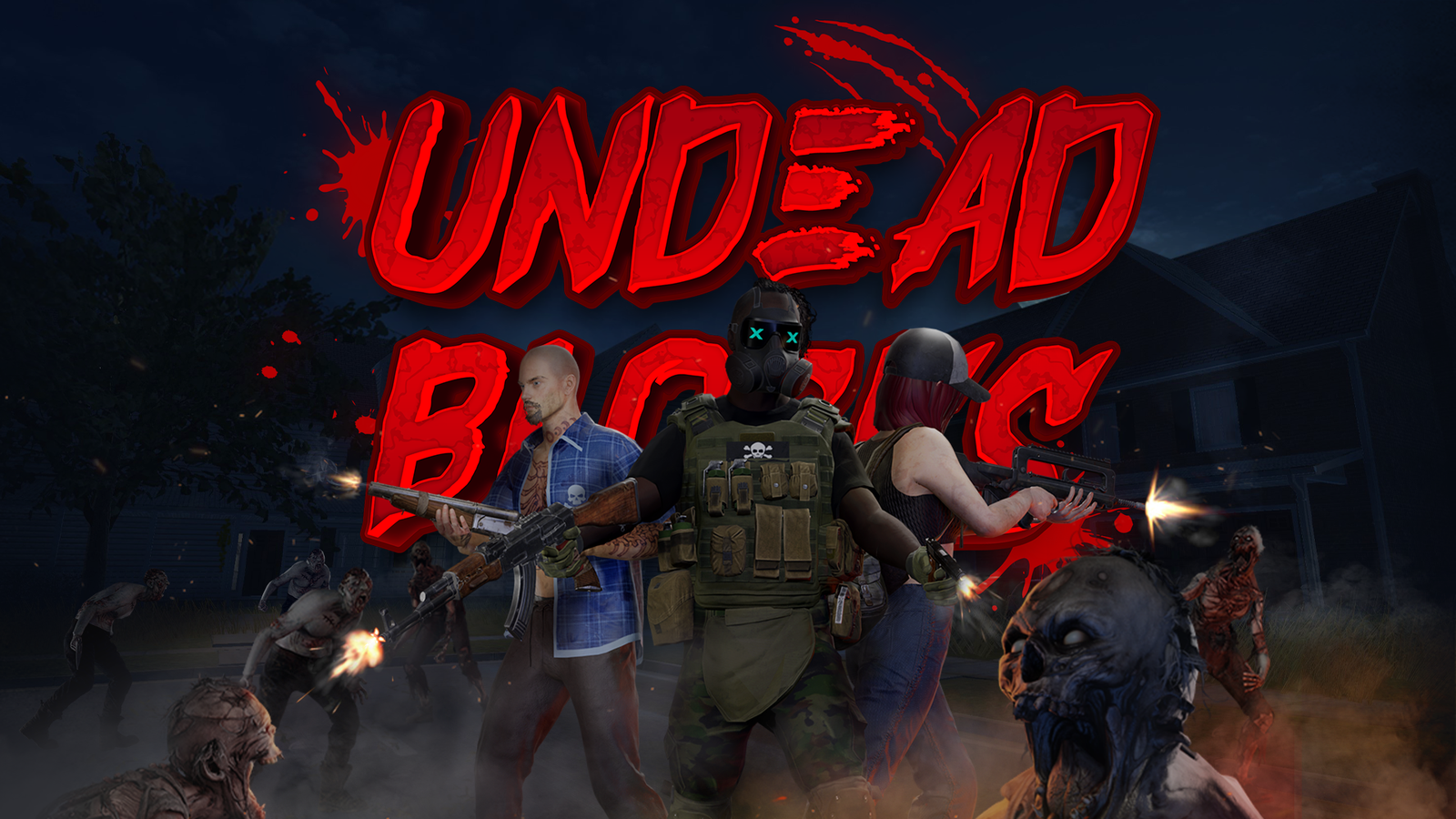

Undead Blocks: Developed by Wagyu Games, this zombie survival shooter lets owners of Genesis and Apocalypse Weapon NFTs rent them to other players via BluMint. Renters enjoy enhanced gameplay, while lenders earn passive income from their digital assets. See how it works

-

Polemos’ Armory: Polemos offers ‘The Armory,’ a platform for renting and staking in-game NFTs without collateral. This lowers entry barriers for gamers and allows NFT owners to monetize unused assets, supporting a more accessible gaming ecosystem. Explore The Armory

The rise of specialized platforms has made NFT lending seamless and secure:

- LootRush: Connects thousands of games with a flexible rental system supporting both custodial and non-custodial methods.

- Undead Blocks: Through BluMint integration, players can rent Genesis or Apocalypse Weapon NFTs and earn passive income as others use them in zombie survival gameplay (details here).

- Polemos’ Armory: Enables collateral-free rentals and staking of game NFTs, lowering entry barriers for new players while letting owners profit from idle assets (learn more).

This ecosystem is further strengthened by technological innovations like IQ Protocol’s smart contracts that automate secure lending without requiring collateral – making risk-free rentals possible at scale.

The Benefits: Why Both Sides Win with NFT Lending

NFT renting creates win-win scenarios for everyone involved:

- For Players: Unlock premium content affordably. No need to drop hundreds on an asset you might only want for a tournament or weekend grind.

- For Asset Owners: Generate passive income from NFTs sitting idle in your wallet. Every unused asset becomes an earning opportunity instead of gathering digital dust.

- The Community: Lower entry barriers mean more diverse participation and richer gameplay experiences across all skill levels.

This dynamic not only enriches individual portfolios but also fuels the broader economy within blockchain games. As more players participate through rentals rather than outright purchases, demand rises for unique items – which can push up values over time. It’s no wonder that savvy traders are now factoring rental yields into their strategies when investing in high-demand NFTs.

One of the most compelling aspects of NFT renting games is the flexibility it brings to digital ownership. Instead of locking up capital in rare items that might only see occasional use, owners can keep their assets working for them around the clock. This model is already driving significant engagement in titles like Undead Blocks, where weapon NFT rentals are giving both newcomers and seasoned players a fresh way to profit or play. As more games adopt these systems, expect to see a surge in creative strategies for maximizing returns on digital collectibles.

For those just getting started, platforms like Polemos’ Armory and LootRush have lowered entry barriers, making it easier than ever to participate. You don’t need a massive upfront investment or deep technical knowledge, just a wallet, some curiosity, and a willingness to experiment with new forms of value exchange. Rental smart contracts handle the heavy lifting, ensuring both sides are protected throughout the process.

Getting Involved: Steps to Start Renting or Lending NFTs

If you’re interested in tapping into this growing market, start by exploring rental marketplaces compatible with your favorite games. Look for platforms with transparent fee structures and strong security features, custodial options offer simplicity for beginners, while non-custodial setups provide more control for advanced users. Always review rental terms carefully and consider starting small as you learn the ropes.

As NFT lending platforms mature, we’re likely to see even more sophisticated features emerge: dynamic pricing based on demand, bundled asset rentals for guilds or teams, and integration with DeFi protocols for additional yield opportunities. The lines between traditional gaming economies and decentralized finance are blurring fast, and those who adapt early stand to benefit most.

Risks and Considerations

- Smart contract risks: While automation increases security, bugs can still occur, stick with audited platforms whenever possible.

- Market volatility: The value of NFTs (and their rental fees) can fluctuate rapidly based on game updates or player demand.

- Regulatory uncertainty: As governments catch up with Web3 innovation, rules around digital asset rentals may evolve quickly.

Don’t let these factors discourage you, just approach NFT renting with the same diligence you’d apply to any investment or trading strategy. Diversification and ongoing research are your best allies as this space continues to evolve.

The bottom line? NFT renting games are transforming how value flows through virtual worlds. For players eager to access premium content without breaking the bank, and asset owners looking for new passive income streams, the future looks bright indeed. Whether you’re lending legendary loot or trying out top-tier gear before buying, this is one trend every digital economy explorer should have on their radar.