Fractionalized NFTs are rapidly redefining digital ownership in gaming, offering unprecedented access to rare in-game items and reshaping how communities interact with virtual assets. Where once only the wealthiest players could own legendary swords, mythical creatures, or prime virtual real estate, fractionalized NFTs in gaming now allow thousands of players to co-own a single coveted asset. This shift is not just technical but deeply social, fostering a sense of shared investment and collective strategy that was previously unattainable.

The Mechanics of Fractionalized NFTs: Breaking Down Digital Barriers

At its core, a fractional NFT (or F-NFT) divides ownership of a unique digital item into smaller, fungible parts. Each part represents a share of the original NFT, and these shares can be freely traded or held by different individuals. In practice, this means that the $100,000 sword once reserved for a single player might now be split into 1,000 shares at $100 each. This innovation dramatically lowers the barrier to entry for participating in high-value digital economies and transforms rare items from exclusive trophies into community assets.

This model is gaining traction thanks to platforms like Axie Infinity and Decentraland. In Axie Infinity, for instance, rare Axies have been fractionalized so players can invest in top-tier creatures without needing deep pockets. Similarly, metaverse worlds such as The Sandbox and Decentraland enable groups to co-own virtual land parcels and share in their appreciation or rental income (source).

Key Benefits: Accessibility, Liquidity, and Community Cohesion

Key Benefits of Shared NFT Ownership in Gaming

-

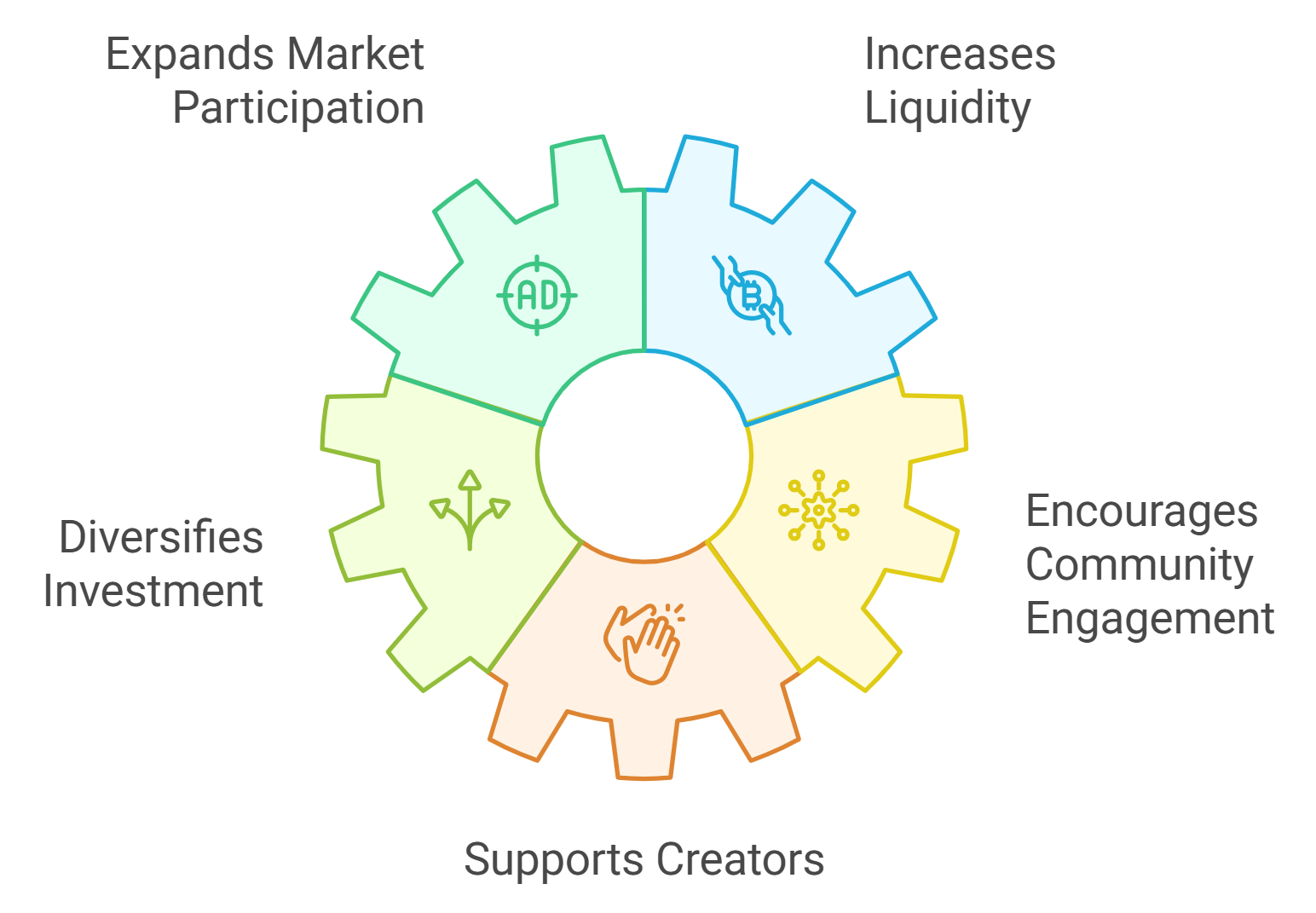

Enhanced Accessibility: Fractionalized NFTs allow players to acquire portions of rare in-game items, lowering the financial barrier and enabling broader participation in high-value assets.

-

Increased Liquidity: By dividing unique assets into tradable shares, fractional ownership makes it easier to buy and sell in-game items, resulting in a more dynamic and liquid marketplace.

-

Community Engagement: Shared ownership fosters collaboration and a sense of community among players, as they collectively manage and benefit from valuable digital assets.

-

New Revenue Streams for Developers: Game developers can monetize rare items by offering fractional ownership, attracting a wider audience and generating additional income through innovative asset offerings.

-

Democratized Investment Opportunities: Players can invest in high-value assets, such as rare characters in Axie Infinity or virtual land in Decentraland and The Sandbox, without needing to purchase the entire asset outright.

The rise of shared NFT ownership in games brings tangible advantages:

- Enhanced Accessibility: Players no longer need significant capital to participate in high-stakes digital economies. Fractionalization opens doors for casual gamers to invest alongside whales.

- Increased Liquidity: Shares can be bought and sold independently on secondary markets, making it easier for players to realize gains or adjust their portfolios as game metas evolve.

- Community Engagement: Co-ownership naturally fosters collaboration, owners may vote on asset usage or collectively decide when to sell or upgrade an item.

- Diversified Revenue Streams: Developers benefit by selling fractions rather than entire assets at once, broadening their customer base while maintaining scarcity and value.

Real-World Implementations: From Axie Infinity to Virtual Land Syndicates

The practical applications extend far beyond theory. In Axie Infinity’s bustling ecosystem, high-value Axies are now accessible through pooled investments, enabling more players to benefit from breeding fees or tournament winnings without sole ownership risk. Meanwhile, metaverse platforms like Decentraland have seen groups syndicate purchases of premium land plots that would otherwise be out of reach for most individuals (source). These syndicates operate much like digital REITs (real estate investment trusts), distributing profits from land appreciation or rental income among shareholders.

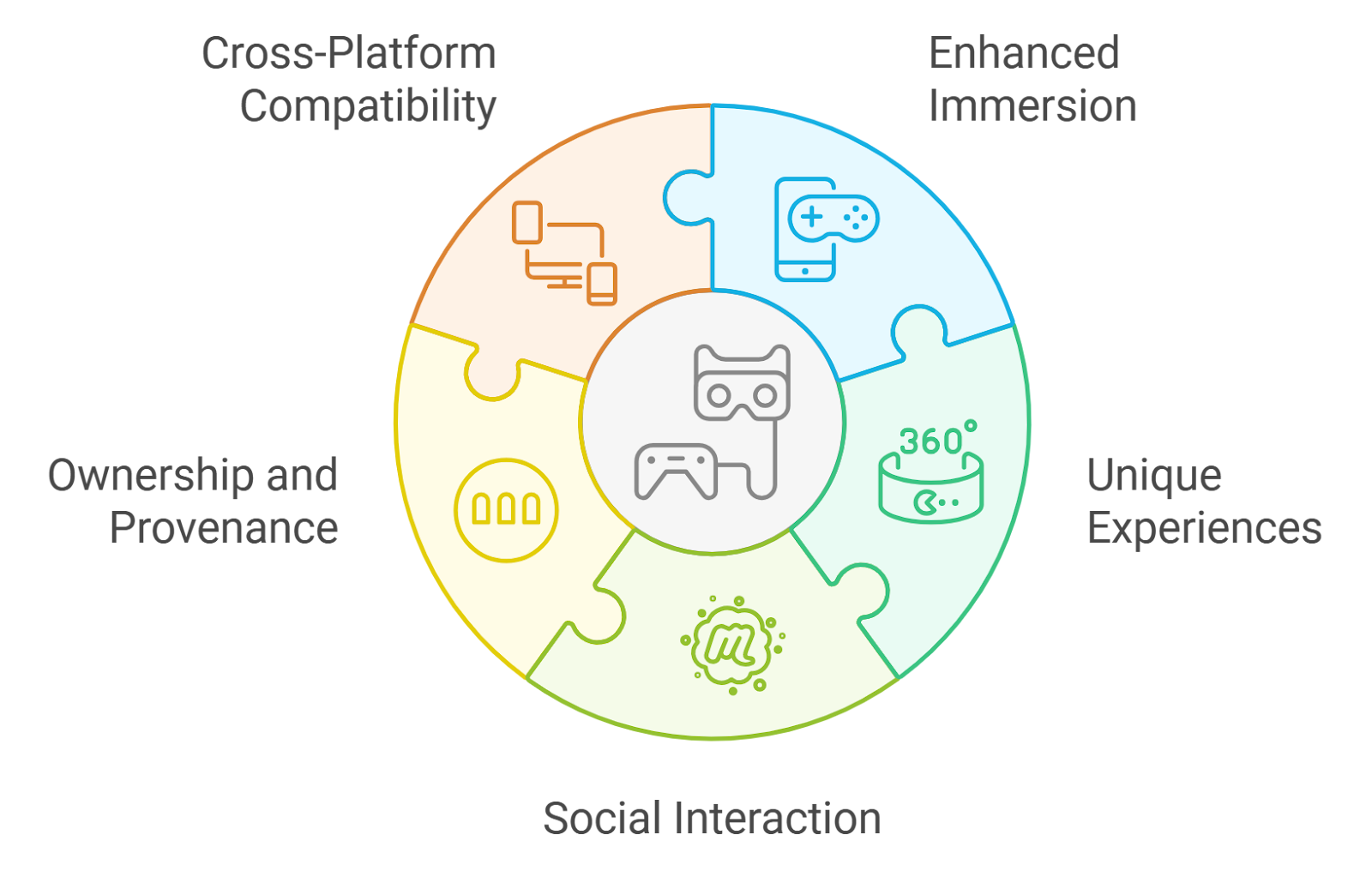

The Social Layer: New Forms of Player Collaboration

This evolution isn’t just economic; it’s inherently social. Shared ownership structures incentivize communication between co-owners, whether organizing events on virtual land or strategizing around asset upgrades. Such models are already inspiring new forms of player guilds and DAOs (decentralized autonomous organizations) dedicated solely to managing pooled NFT assets across multiple games.

Yet, as with any disruptive technology, the promise of fractionalized NFTs gaming comes with its own set of complexities. The regulatory landscape is still in flux, and questions about asset valuation and governance loom large. For instance, how do you fairly determine the value of a single share in a rare NFT when demand can swing wildly based on game updates or community sentiment? And what happens when co-owners disagree on whether to sell, upgrade, or utilize an asset in-game?

Risks and Challenges: Navigating the New Shared Economy

There are several challenges that both players and developers must address as the rare NFT items shared economy matures:

- Regulatory Uncertainty: As legal frameworks catch up with blockchain innovation, participants face potential risks related to securities laws and investor protections. Jurisdictions may differ dramatically in their treatment of shared digital assets.

- Valuation Volatility: The price of fractional shares can be highly volatile, especially for unique items whose value is driven by community hype or game mechanics. This can lead to speculative bubbles or sharp corrections.

- Smart Contract Security: The integrity of fractionalized assets depends on robust smart contract design. Any vulnerabilities could expose owners to hacks or loss of funds.

- Governance Disputes: Co-ownership requires clear rules for decision-making. Without effective governance mechanisms (such as voting protocols or automated DAOs), disagreements can paralyze asset management.

The market is responding with innovative solutions: decentralized governance tools, insurance products for digital assets, and transparent pricing models are all emerging to mitigate these issues. Still, participants should approach new opportunities with due diligence and a willingness to adapt as standards evolve.

The Future Outlook: Democratizing Digital Value Creation

The momentum behind fractional ownership shows no signs of slowing down. As more games adopt NFT-driven economies and interoperability between platforms improves, we may see entire virtual worlds where every rare item is accessible through collective investment. This could fundamentally shift how value is created and distributed in gaming – moving from closed ecosystems dominated by a few high spenders to open economies where communities shape their own destinies.

This evolution will likely spark new forms of gameplay centered around collaboration rather than competition for scarce resources. Imagine guilds pooling resources to acquire legendary weapons or players forming syndicates to develop virtual neighborhoods that generate ongoing revenue for all shareholders.

The bottom line? Fractionalized NFTs are not just a technical upgrade; they represent a philosophical leap toward more inclusive digital ownership structures. By lowering financial barriers and emphasizing collective action, they unlock new possibilities for both players and creators in the rapidly expanding NFT metaverse.